The 2022 Singapore Budget revealed a number of key initiatives that revolved around investing in new capabilities, renewing & strengthening social compact, advancing green transition, and building a fairer and more resilient tax system. As always, there will be tax planning implications for your business. We’ve distilled down the main changes that you’ll need to be aware of in order to maximise the benefits for your company.

You can download the full Singapore Budget 2022 Report below to understand the implications on your corporate tax planning.

If you have any questions relating to any of the information contained in this report, please contact our tax advisors via email or call us at +65 6230 9788.

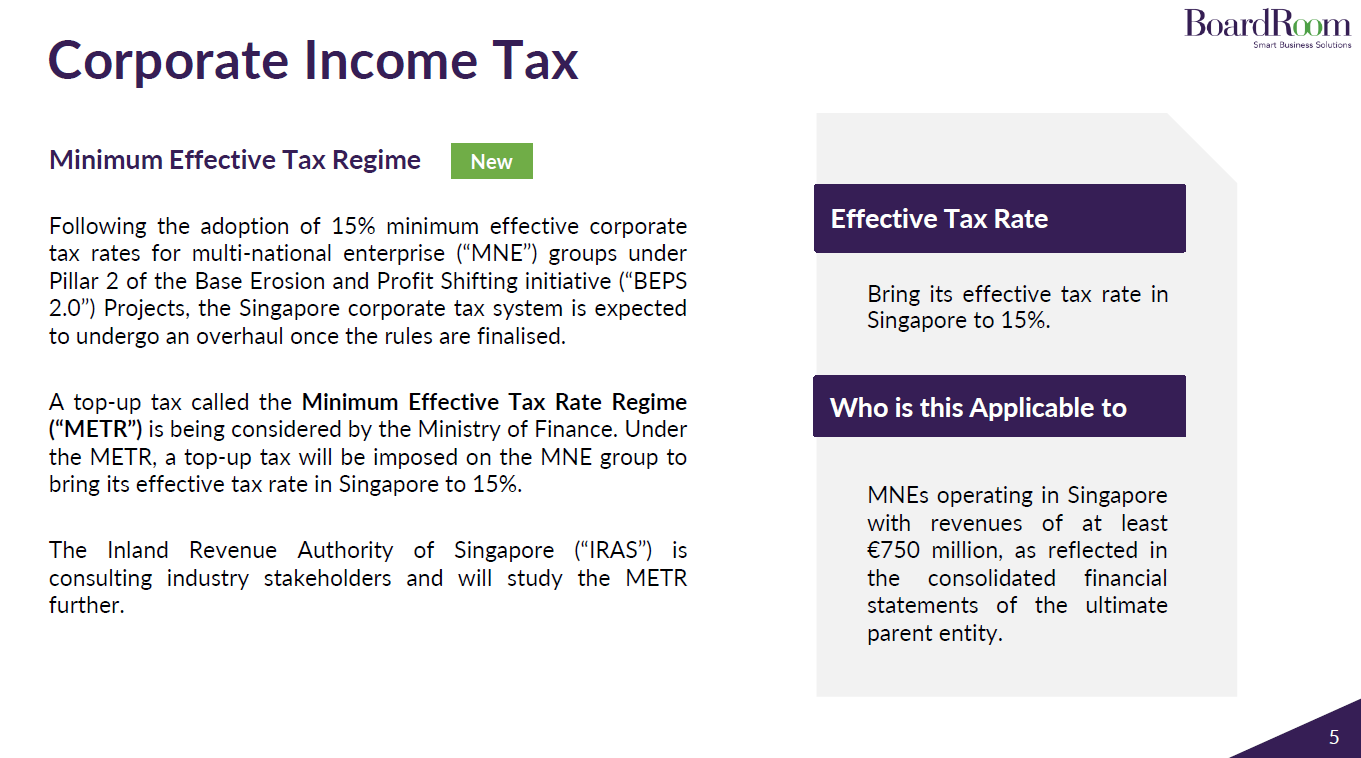

Corporate Income Tax

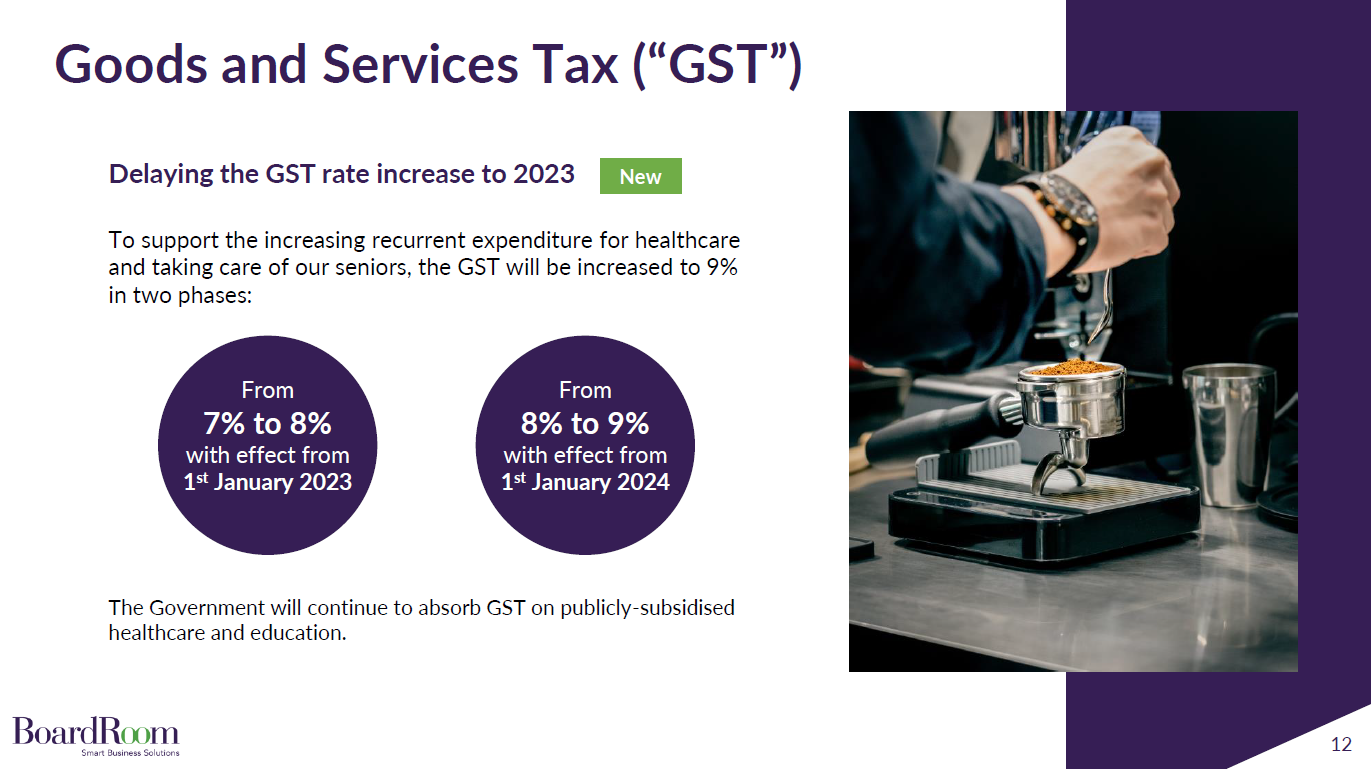

GST rate increase delay

Enhanced financing support for business

Investing in Digital Capabilities

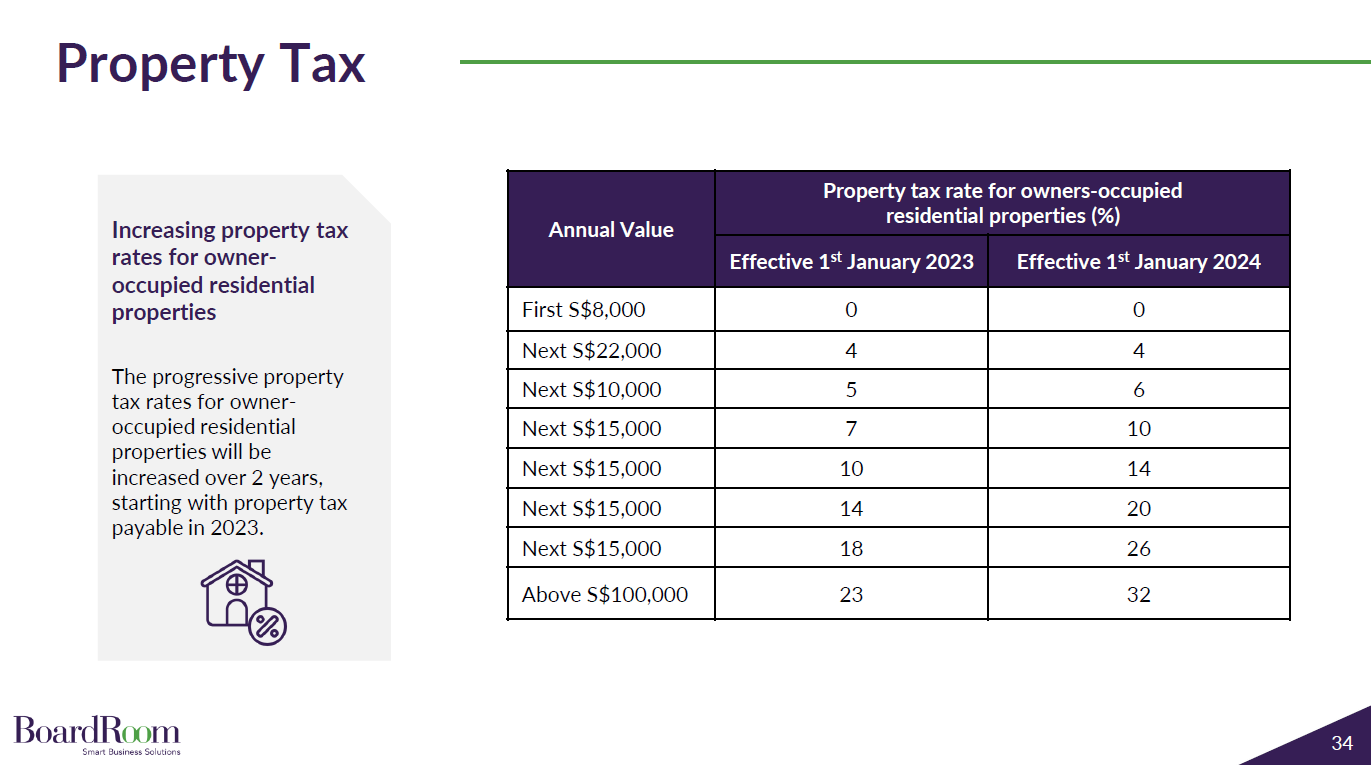

Property Tax

Related Business Insights

-

17 Oct 2024

Payroll Best Practices: Your Guide To Financial Services Payroll Management

Effective payroll management in financial institutions is key to compliance and risk reduction. Find out what you c …

READ MORE -

07 Oct 2024

Your Guide to Global Mobility Tax Solutions

Discover ways to navigate tax and compliance when working with international assignments with global mobility tax s …

READ MORE -

06 Sep 2024

Case Study: Optimising Tax Efficiency in Profits Repatriation

Discover how BoardRoom's two-step tax approach helps a multinational conglomerate evaluate tax-efficient profit rep …

READ MORE