As Singapore moved into a post-pandemic era, the Singapore 2023 Budget focused on building capabilities and seizing opportunities in a new era of global development. The budget centred on 3 key thrusts – growing the economy, strengthening social compact and building collective resilience. We’ve summarised the key changes that you’ll need to be aware of, in order to maximise the benefits for your company.

To discover insights and updates on the tax incentives announced that will implicate your tax planning, download our Singapore 2023 Budget Report.

If you have any questions relating to the information contained in this report, please contact our tax advisors via email or call us at +65 6536 5355.

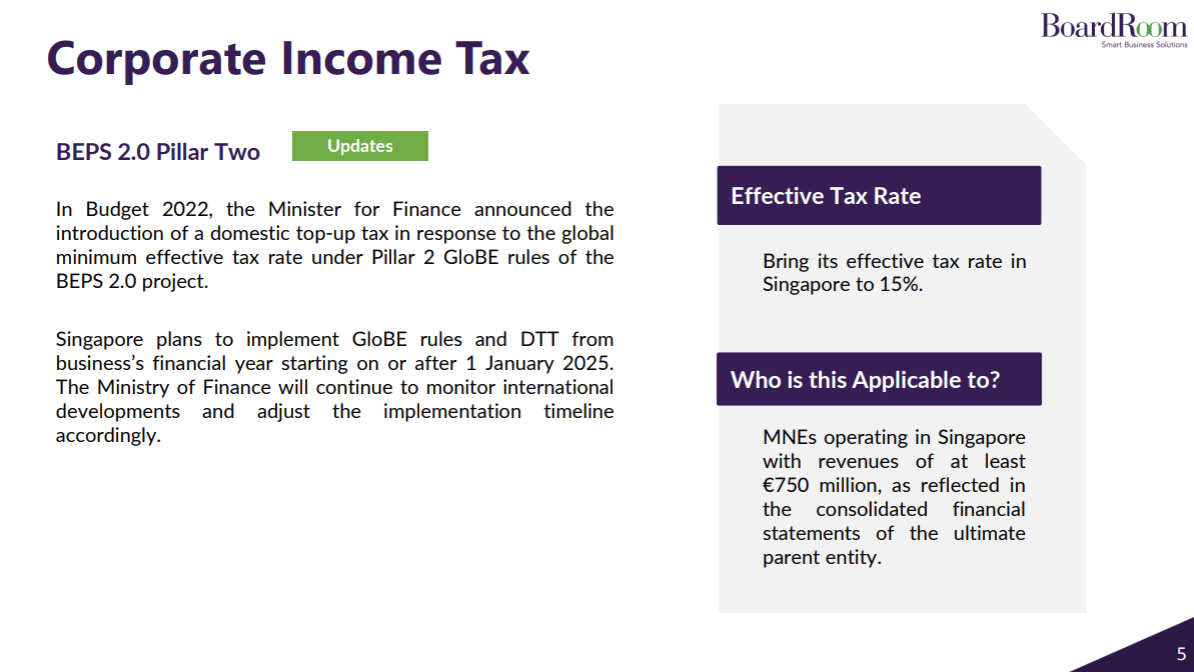

Corporate Income Tax

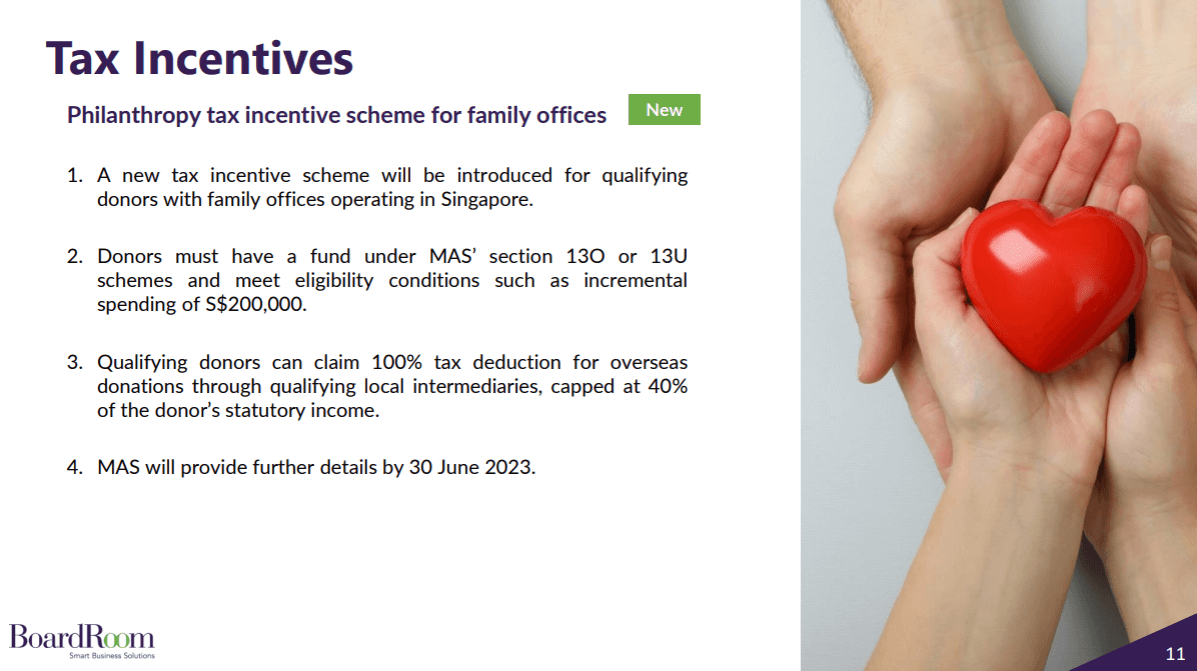

Philanthropy tax incentive scheme for family offices

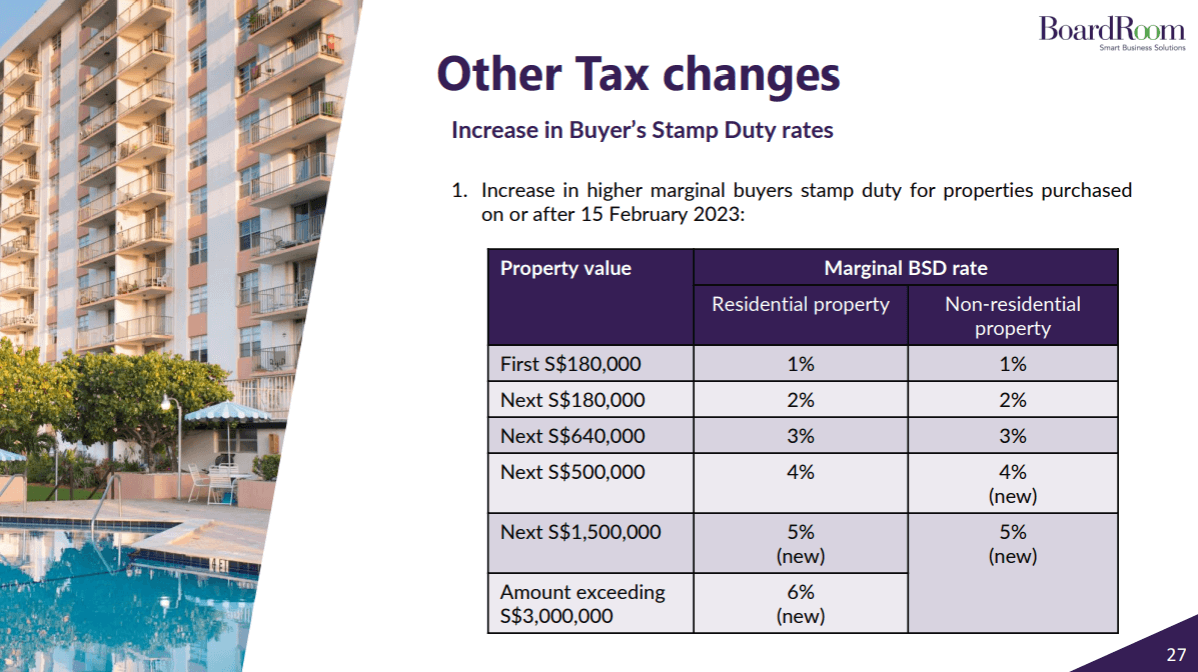

Increase in Buyer’s Stamp Duty rates

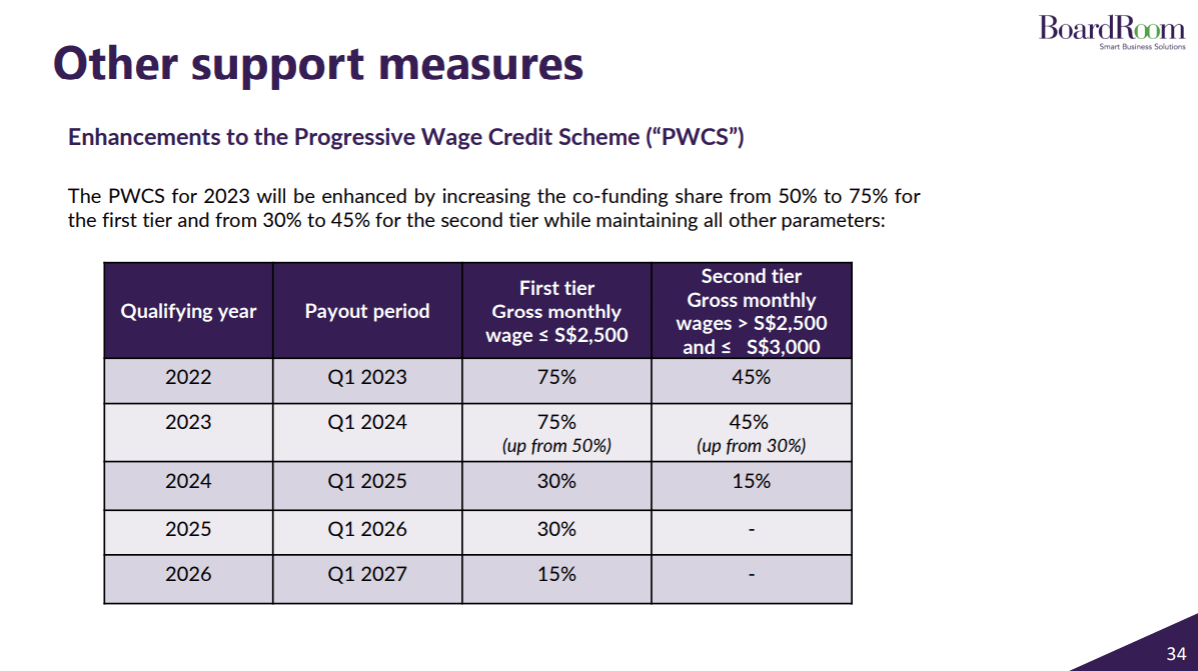

Enhancements to the Progressive Wage Credit Scheme (“PWCS”)

Related Business Insights

-

08 Jul 2024

Your Guide to Corporate Tax Filing in Singapore

Learn to navigate corporate tax filing in Singapore effectively and ensure timely, compliant submissions with our c …

READ MORE -

14 Jun 2024

Comprehensive Guide to XBRL Filing Requirement in Singapore

Explore the essentials of XBRL filing in Singapore, covering mandatory requirements, benefits, preparation steps, a …

READ MORE -

11 Jun 2024

Corporate governance best practices at all levels of the company

Corporate governance goes beyond compliance, shaping the fabric of an organisation. Discover the corporate governan …

READ MORE