Our payroll services

Whether you operate solely in Singapore or have a presence in other countries across the Asia-Pacific region, BoardRoom can help with all your payroll outsourcing needs.

01 Singapore payroll services

Our team of highly trained payroll professionals can help you to navigate Singapore’s ever-changing payroll compliance regulations. As well as looking after your payroll administration, they are available to answer any questions you have and provide solutions to any potential payroll issues.

We can help with:

02 Regional payroll services

We offer payroll outsourcing services in 19 countries and regions, including:

Singapore

Singapore Australia

Australia China

China Hong Kong

Hong Kong India

India

Indonesia

Indonesia Japan

Japan Macau

Macau Malaysia

Malaysia

Myanmar

Myanmar New Zealand

New Zealand Philippines

Philippines South Korea

South Korea

Thailand

Thailand Taiwan

Taiwan UAE

UAE Vietnam

Vietnam

We also offer flexible payroll solutions with options to either:

- centralise coordination through BoardRoom Singapore; or

- decentralise coordination via our network of local offices.

We can help with:

- payment and lodgement of local statutory obligations and filings

- processing of multi-country pay runs;

- combined payroll and tax services;

- electronic management of employees’ leave and expense claims; and

- international payroll services.

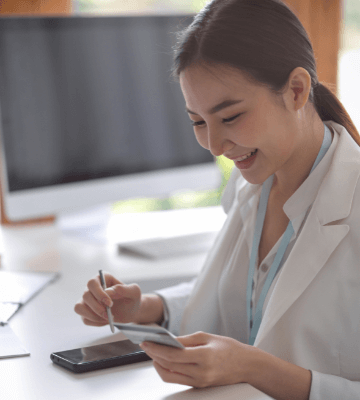

03 Power up your payroll

Our payroll solutions are powered by Ignite, our all-in-one cloud-based HRMS platform.

Ignite is built for the future, streamlining your payroll efficiency by eliminating the need for multiple payroll systems. It provides unparalleled reporting capabilities and a true online multi-country payroll processing experience.

With Ignite, you can enjoy:

- a complete HRMS solution with multi-country payroll, leave and claims processing;

- full statutory compliance with local legislation in nine countries and regions across Asia;

- flexible automated leave solution and automated payroll processing;

- an intuitive mobile app for instant access to payslips, claims and leave application and submission;

- attendance-clocking technologies, a shift calendar and a staff rostering system; and

- a dedicated account manager and one easy point of contact.

Ignite helps to boost the efficiency of your regional payroll processing and gives your leaders more control and foresight for future planning.

Frequently Asked Questions (FAQs)

1. How do outsourced payroll services work?

Outsourced payroll services mean that you hire a third-party company to take care of your payroll services. This is particularly useful for companies who are struggling to keep up with local regulatory compliance or a growing workforce. By outsourcing you will ensure your employees are paid accurately, on-time and you will also have peace of mind that your business is fully compliant to local regulations around mandatory contributions.

There are different types of payroll solutions for different types of businesses. You can adopt a full outsourcing solution where the vendor takes care of everything from calculating disbursements to pay runs and reporting. Alternatively, you can adopt a simpler solution that just entails completing the monthly pay run with data supplied by the client.

2. How to choose the right payroll and HR service for your business?

When it comes to payroll and HR services, it’s important to understand that different businesses require different solutions.

The best way to find a payroll solution that fits your business is to first identify what your business needs. Will you need real-time calculations? How about paychecks and direct deposits? Tax filing services?

By identifying your needs, it will be easier to identify which payroll and HR service can best suit those needs. If you need any help identifying your business’s needs, give us a call today.

3. What are the pros and cons of outsourcing payroll?

While this will vary for each business, here are some of the more commonly voiced pros and cons of outsourcing payroll.

Pros

- Your taxes will be filed in compliance with tax laws and regulations

- Outsourcing can be less costly than hiring someone fulltime

- Your employees will be paid on time and your business will be fully compliant with local statutory requirements

Cons

- You could possibly be paying for services that your business doesn’t need

- You’re putting highly sensitive payroll data in the hands of an external provider

4. Is it more expensive to outsource payroll as compared to doing it in-house?

Typically speaking, handling payroll in-house is more expensive than outsourcing payroll.

This is because employing an in-house expert can be costly. Aside from mitigating cost from an operation standpoint, outsourcing your payroll can also reduce your fixed business costs by saving on technology infrastructure and implementation as the responsibility should fall on your outsourced provider.

5. What software do you use for payroll management?

Here at BoardRoom, we use Ignite, which is an all-in-one cloud based HRMS tool for our payroll management. This software helps businesses of all sizes automate their payroll so they can increase their productivity.

Ignite HRMS has 5 core modules including payroll, leave, claims, time clock & attendance. It offers multi-country payroll processing ensuring full compliance with local statutory obligation across 9 countries in Asia.

6. What is multi-country payroll outsourcing?

Multi-country payroll outsourcing, otherwise known as MCPO allows businesses that operate in more than one country/currency to handle all their payroll and offer best local practices through a single provider.

MCPO can allow parallel comparison of payroll cost between countries through standardisation. For instance, a company can adopt a common definition of payroll cost i.e., Allowance A, B and C to make effective comparison of cost performance for companies that operates across multiple countries. A sophisticated MCPO software is a must-have for any business or enterprise that operates in multiple countries.

Secondly, payroll regulation in emerging countries can often change leaving internal HR teams stranded with insufficient knowledge and expertise to execute change with their employees. Hence, companies can gain insights and knowledge of local practices by leveraging an MCPO provider who has an in-depth knowledge of changing local regulations.

7. What is the difference between HR and Payroll?

The difference between HR and Payroll depends on the business in question.

While most businesses consider payroll to be a sub-function of their HR department, many companies don’t have HR departments and thus Payroll sits separately.

Basically, Payroll is the function associated with actioning your employees’ remuneration packages in your agreed pay cycle. Whereas the wider HR function is responsible for a wealth of other areas like talent attraction and retention, employee benefits, employee training and development and much more.

8. What services should payroll outsourcing companies offer?

At a basic level, a payroll outsourcing vendor should be able to:

- Process payroll including payments of salaries, bonuses and other remuneration items

- Provision of employee net pay file, funding request i.e. local statutory contribution, and month-end payroll reports

- Administer the deposit of net payroll into the employee’s bank accounts

- Administer payment of local statutory contribution

- Preparation and submission of annual income tax and other local tax obligation

In the search for more comprehensive payroll outsourcing services, several outsourcing providers can offer their own proprietary HRMS system for their clients use. This allows companies to have full access to the HRMS system and add other modules like leave, claims or time & attendance modules to suit the company’s needs.

Alternatively, some companies can request for integration of their existing ERP system i.e. SAP, Workday with the service provider’s by uploading payroll information into their system.

9. How secure is outsourcing payroll?

Outsourcing your payroll can be very secure, but it is recommended to pick a reputable company that focuses on security and has the experience to back it up.

In addition to this when evaluating reputable vendors, a good measure of their security if any certifications they may have. Some commons certifications to look for in a payroll outsourcing vendor is ISO 9001, ISO 27001, SOC2.

In Singapore, you can take this a step further and seek a vendor who has an Outsourced Service Providers Audit Report (“OSPAR”). Being awarded OSPAR indicates that a company is in full compliance with the Association of Banks in Singapore’s guidelines. To remain OSPAR certified the outsourcing service provider must have the relevant measures and controls in place and implement these consistently.

BoardRoom is proud to say we have attained official OSPAR certification for 3 years in a row.

10. How can BoardRoom help in payroll services?

Here at BoardRoom, we have the best tools and most secure software to help businesses handle their payroll. Our experienced staff can guide you through payroll management in a way that is secure and efficient. With regional experience and our winning Ignite platform, BoardRoom is fully equipped to handle payroll services for businesses of all sizes.

For more information on Payroll outsourcing or our Multi-country Ignite Payroll software, please contact us today.