Performance Share Plans (PSP) serve as a strategic tool for companies aiming to align employee performance with organisational success. This comprehensive incentive program grants employees shares based on predetermined performance criteria.

Introduction of Performance Share Plan (PSP)

In this guide to Performance Share Plans, we explore the various aspects of this incentive structure. From understanding its core functionality to navigating the diverse benefits it offers, we provide insights into the establishment requirements, tax implications, and associated risks.

How Performance Share Plans Function

A Performance Share Plan (PSP) is an executive compensation strategy that aligns the interests of company leaders with overall organisational success. In a PSP, executives receive awards in the form of shares, and these awards are contingent on achieving predefined performance targets. The performance is typically measured against specific financial, operational, or strategic metrics. As executives meet or exceed these goals, they unlock shares, creating a direct link between their performance and financial rewards.

Advantages of Performance Shares

Performance Share Plans (PSPs) offer several benefits. They serve as strong incentives by directly tying executive rewards to the company’s performance, motivating executives to contribute to overall success. PSPs also encourage a focus on long-term goals, fostering sustained achievements. Moreover, they help retain talent by giving executives a stake in the company’s success, reducing turnover. These plans provide a clear and measurable way to evaluate executive performance, creating a results-driven culture. In essence, implementing PSPs strategically enhances organisational performance and strengthens the connection between executive leadership and corporate success.

Types of Performance Shares

Performance Shares come in various types, offering flexibility for companies to tailor incentive structures to their specific needs.

Here are some common types of Performance Shares:

Requirement To Establish a PSP

Establishing a Performance Share Plan in Singapore involves a comprehensive approach. Firstly, in the design phase, clear objectives must be defined, aligning them with the company’s overarching goals. Additionally, specifying performance metrics that determine share or cash allocations is crucial. Legal and regulatory compliance is vital, requiring adherence to regulations set by the Accounting and Corporate Regulatory Authority (ACRA) and the Monetary Authority of Singapore (MAS).

Transparent communication with employees is essential, detailing the criteria for earning shares, the potential value of the awards, and clarity on vesting schedules and conditions. Employee eligibility is determined based on factors like job level, performance, and tenure, and the plan’s scope may include all employees or specific groups. Establishing performance metrics involves outlining key indicators relevant to the company’s objectives. Defining a vesting period with a graded approach encourages employee retention. Valuation methods for PSP awards, whether in shares or cash equivalents, need to be consistent and fair.

Efficient administration and record-keeping systems, potentially utilising specialised software are essential. Understanding tax implications for both the company and employees is important, involving consultation with tax professionals for compliance with Singapore’s tax laws. Obtaining board approval aligning with the company’s overall compensation strategy is the final step, ensuring the success of the PSP in motivating employees and aligning their interests with the company’s performance. Consulting legal, financial, and HR professionals is advisable throughout the design and implementation phases to ensure a seamless process.

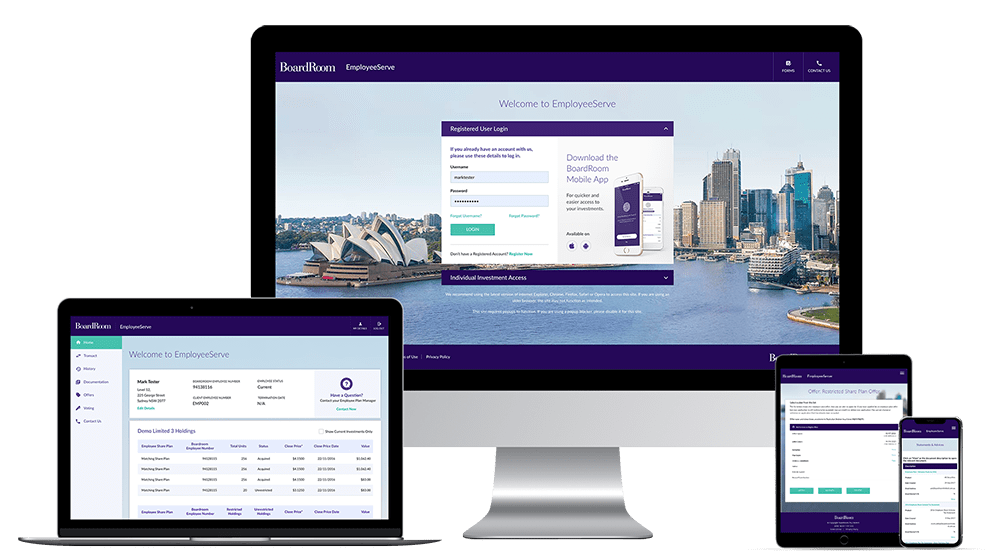

Explore our comprehensive ESOP platform that simplifies the management and administration of your Performance Share Plan (PSP).

Tax Treatment of PSP

The tax treatment of a Performance Share Plan (PSP) varies by locations and design features, with key considerations:

Restriction and Risk on Performance Share

Implementing a Performance Share Plan (PSP) comes with certain restrictions and risks that require careful consideration:

Frequently Asked Questions (FAQs)

Can performance shares decrease in value?

The value of performance shares can decrease. The value of performance shares is often tied to the company’s stock price or other predetermined performance metrics. If the company’s stock price declines or if the predetermined performance goals are not met, the value of the performance shares can decrease. This is a risk associated with performance-based compensation plans, as the value is contingent on the company’s overall performance.

Are there tax implications for receiving performance shares?

Yes, there are tax implications for receiving performance shares. The taxation of performance shares can vary based on the jurisdiction and specific tax regulations. In many cases, taxation occurs when the performance shares vest or when the recipient sells the shares. In some jurisdictions, the value of the performance shares at the time of vesting may be treated as ordinary income, subject to income tax.

Can performance share plans be customised for different employees?

PSP in Singapore can be customised for different employees. Companies often tailor PSPs to align with their organisational goals, individual roles, and employee preferences. Customisation may involve varying performance metrics, vesting periods, or the number of shares granted based on factors such as seniority, job responsibilities, or performance expectations.

Related Business Insights

-

08 Jul 2024

Your Guide to Corporate Tax Filing in Singapore

Learn to navigate corporate tax filing in Singapore effectively and ensure timely, compliant submissions with our c …

READ MORE -

14 Jun 2024

Comprehensive Guide to XBRL Filing Requirement in Singapore

Explore the essentials of XBRL filing in Singapore, covering mandatory requirements, benefits, preparation steps, a …

READ MORE -

11 Jun 2024

Corporate governance best practices at all levels of the company

Corporate governance goes beyond compliance, shaping the fabric of an organisation. Discover the corporate governan …

READ MORE