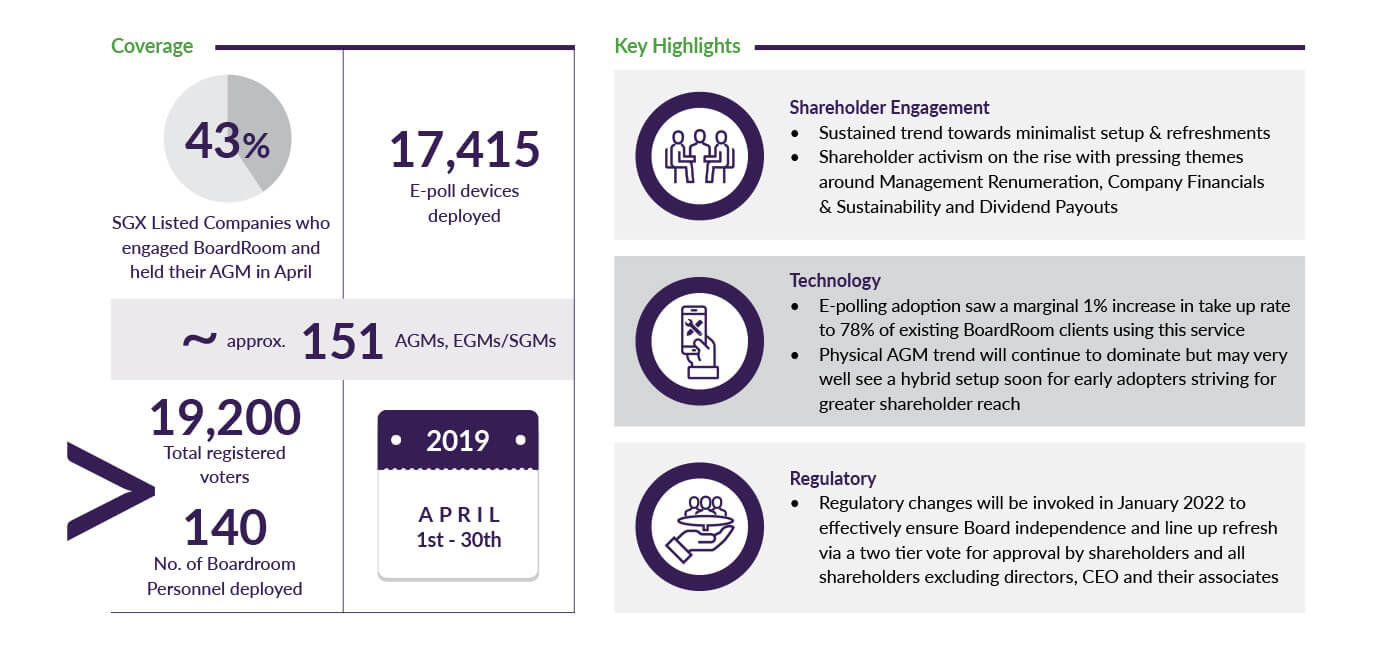

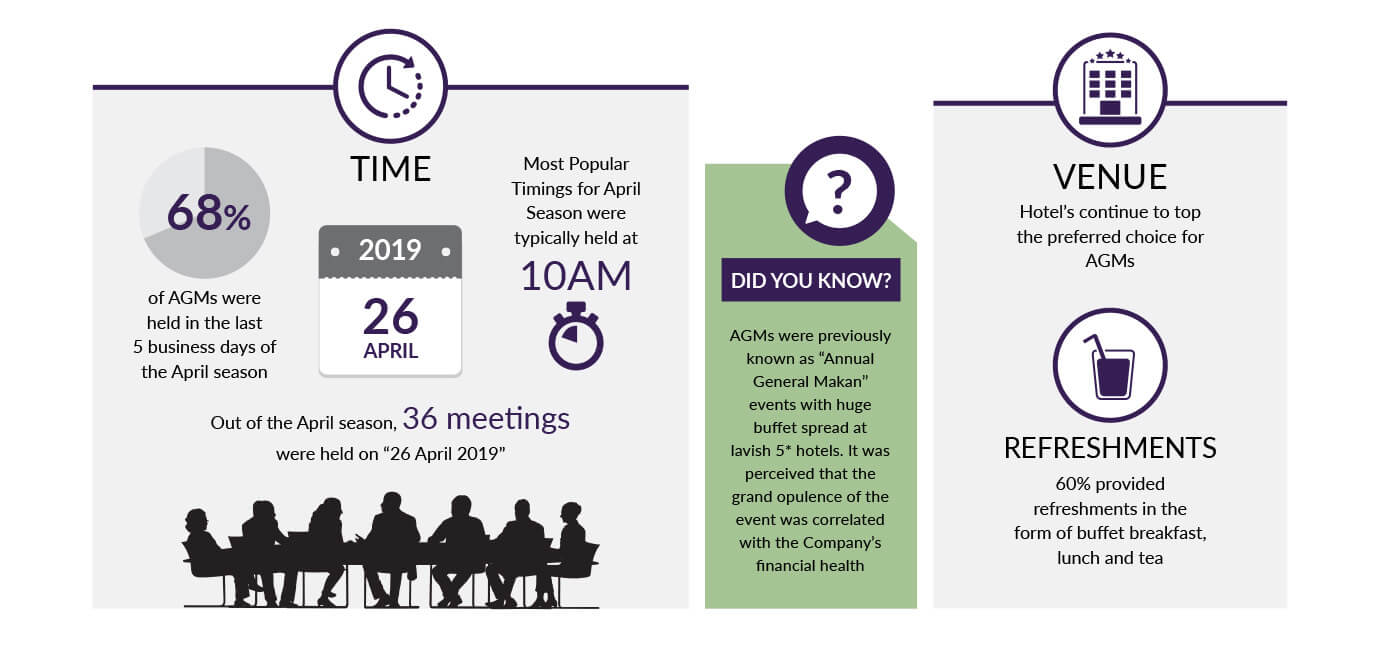

An in-depth report of the future of Singapore AGMs

In post-pandemic 2023 where shareholder meetings have veered from virtual AGMs to physical AGMs, find out the shifts behind these AGM trends and how hybrid meetings utilising webcasts can be a bridge to enhance efficiency and inclusivity.

As Singapore’s leading Meeting Services provider, BoardRoom has conducted 173 shareholder meetings in April 2023, and we share our key findings and takeaways on the future of meetings. In this comprehensive report, we delve deep into the current landscape of AGMs to understand the trend and shift in the various formats. Explore the reasons behind this shift and pick up practical tips in organising a successful AGM, so you can identify opportunities and risks while planning for future meetings.

Download the report to make an informed decision for your next AGM.

Download 2023 Singapore AGM Insights Report

Related Business Insights

-

08 Jul 2024

Your Guide to Corporate Tax Filing in Singapore

Learn to navigate corporate tax filing in Singapore effectively and ensure timely, compliant submissions with our c …

READ MORE -

14 Jun 2024

Comprehensive Guide to XBRL Filing Requirement in Singapore

Explore the essentials of XBRL filing in Singapore, covering mandatory requirements, benefits, preparation steps, a …

READ MORE -

11 Jun 2024

Corporate governance best practices at all levels of the company

Corporate governance goes beyond compliance, shaping the fabric of an organisation. Discover the corporate governan …

READ MORE