In our commitment to keeping you abreast of pivotal developments, we are pleased to present our commentary of Singapore’s Budget 2024, unveiled by Deputy Prime Minister and Finance Minister Lawrence Wong on 16 February 2024, themed “Building Our Shared Future Together”.

Reflecting on the fiscal year 2023, Singapore exceeded revenue expectations, primarily driven by higher Corporate Income Tax collections.

Against this positive backdrop, Budget 2024 is strategically positioned to propel the Forward Singapore agenda. Our detailed Singapore Budget 2024 Commentary delves into the key tax measures affecting both businesses and individuals.

Key tax measures for businesses

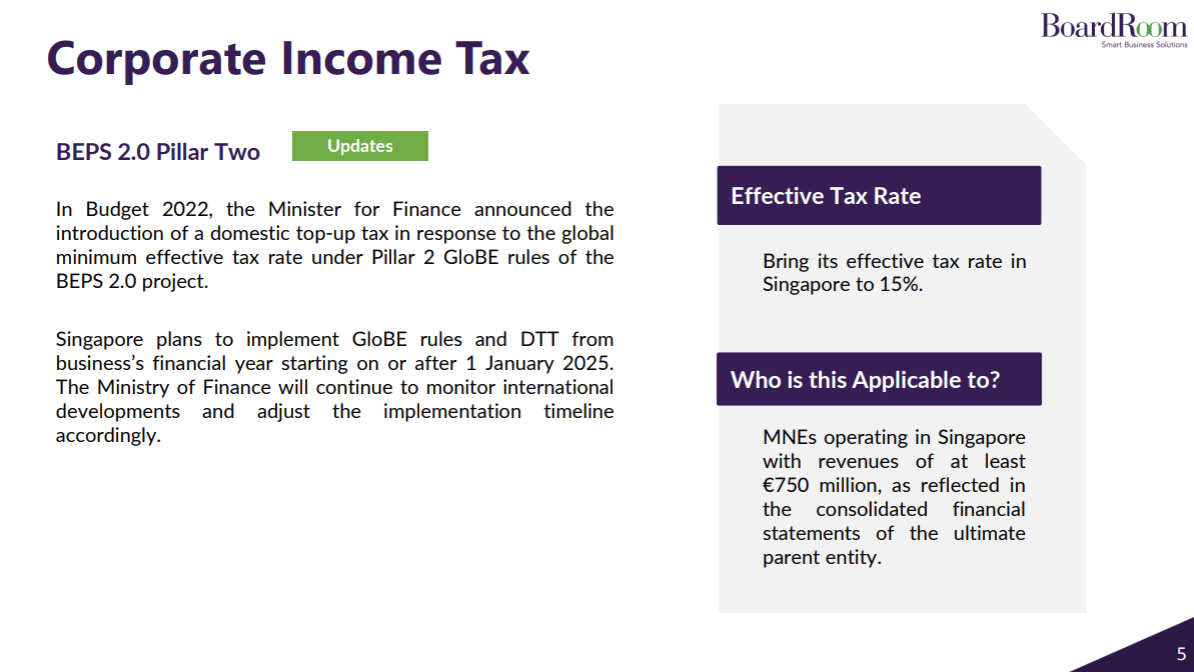

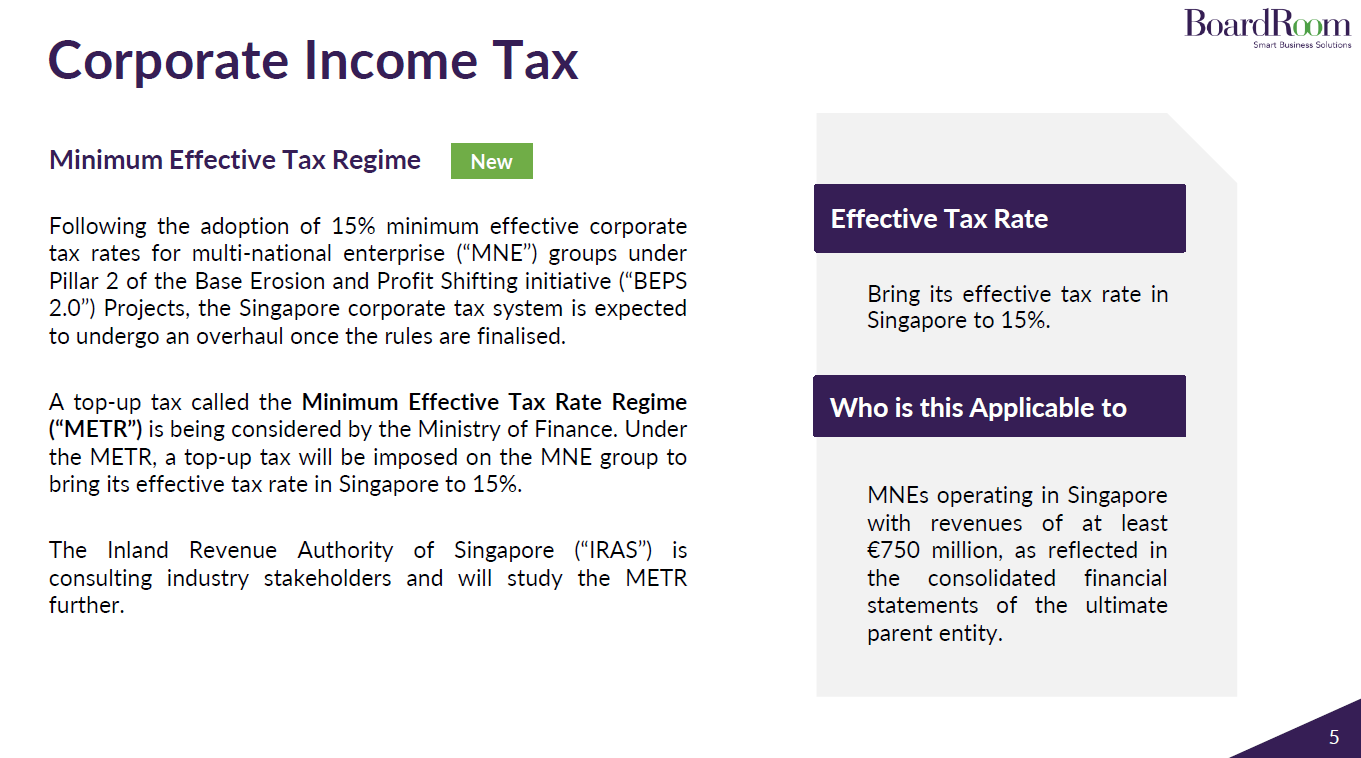

- Singapore’s Implementation of Pillar Two of Base Erosion and Profit Shifting (BEPS) 2.0 initiative

- Introduction of the Refundable Investment Credit (RIC) Scheme

- Introduction of Corporate Income Tax (CIT) Rebate and CIT Rebate Cash Grant

- Enhancement of Tax Deduction for Renovation or Refurbishment (R&R) Expenditure

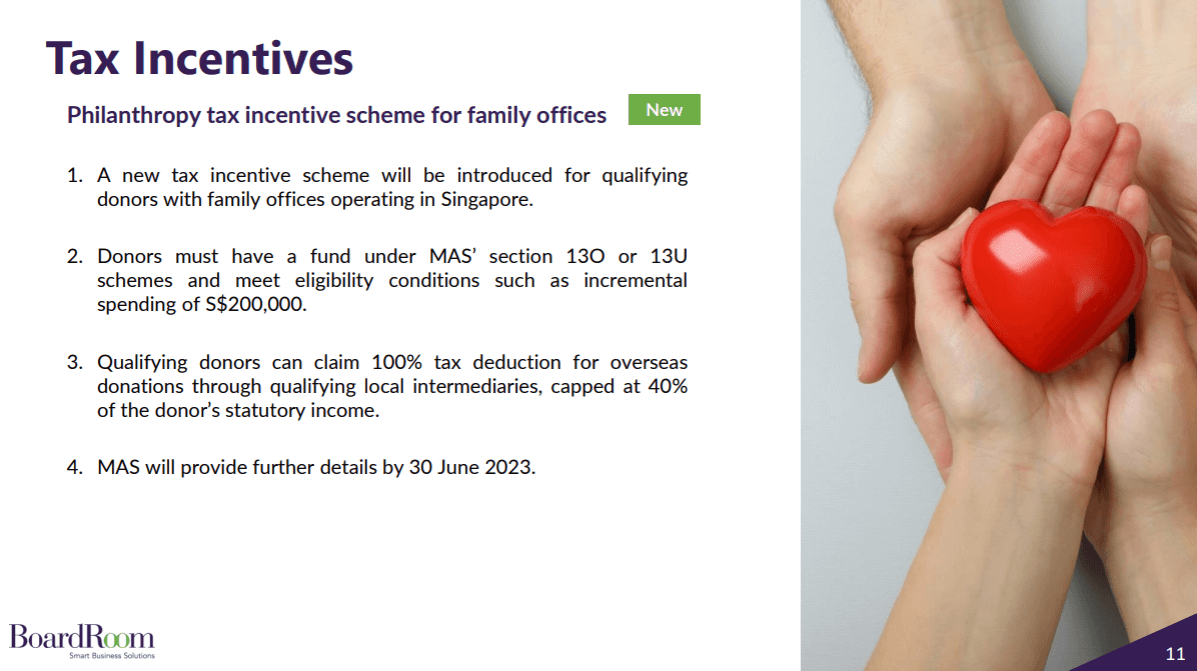

- Extension and Revision of Tax Incentive Schemes for Qualifying Funds

- Introduction of Alternative Basis of Tax for Three Maritime Sector Incentive (MSI) Sub-schemes

- Introduction of Additional Concessionary Tax Rate (CTR) Tiers

Key tax measures for individuals

- Introduction of Personal Income Tax Rebate

- Increasing Annual Income Threshold for Dependent-Related Relief

- Impending Lapse of Course Fees Relief (CFR)

- Removal of Tax Relief for CPF top up qualifying for Matched Retirement Saving Scheme (MRSS)

Other key tax measures

- Introduction of Overseas Emergency Humanitarian Assistance Tax Deduction Scheme (OHAS)

- Withdrawal of Income Tax Concession on Royalty Income

As we collectively navigate the Forward Singapore agenda, understanding these fiscal changes becomes paramount. Download our commentary now to stay informed and ahead.

Should you have any questions on how to maximise your tax position with this latest announcement, please email our tax team at [email protected].

Related Business Insights

-

05 Apr 2024

What Are the Key Benefits of Outsourcing Accounting Services?

Explore the advantages of engaging BoardRoom’s accountancy services, a leading accounting firm offering tailored …

READ MORE -

05 Apr 2024

What Factors Should Businesses Consider When Choosing the Right Accounting Firm?

Explore key factors for choosing the right accounting firm. Partner with BoardRoom for the best financial managemen …

READ MORE -

22 Mar 2024

ESG Reporting Essentials – Your Guide to ESG Reporting in Singapore

Boost transparency and build trust with comprehensive sustainability tracking and ESG reporting solutions. …

READ MORE