On 24th February 2021, Finance Secretary Paul Chan announced the Hong Kong Budget 2021.

The budget suggests a targeted approach as the authorities focus on investing in infrastructure and promoting the development of industries in their bid to optimise strategies.

There is also a significant focus on digitalisation in this year’s Budget, further emphasising the importance of being digitally ready in today’s environment.

If you have any questions relating to any of the information contained in this report, please contact our tax advisors via email or call us at + 852-2598 5234.

Short-Term Relief

Long-Term Measures

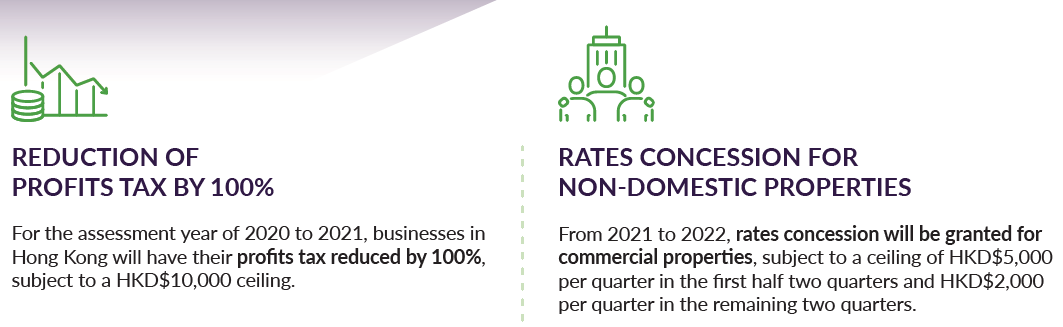

Tax Relief

Digitalisation

Download the Full Hong Kong Budget 2021 Report

Related Business Insights

-

10 Jul 2024

What Is a Business Registration Certificate?

Secure your Business Registration Certificate in Hong Kong to ensure compliance and enhance credibility. Learn the …

READ MORE -

07 May 2024

Guide to Filing Annual Returns in Hong Kong

Streamline your Hong Kong business's annual returns filing with this essential guide, covering everything from prep …

READ MORE -

22 Mar 2024

ESG Reporting 101: Your Comprehensive Guide

Dive into ESG reporting in Hong Kong with this comprehensive guide. Understand ESG basics and best practices for re …

READ MORE