The accounts payable process is a critical aspect of every business. It ensures invoices are paid on time to maintain healthy cash flow management for corporate financial stability, improve operational efficiency, and foster strong relationships with vendors and suppliers while complying with relevant regulations.

In this guide, we’ll explore the definition and role of accounts payable in Malaysia, its process, and why it is important to consider outsourcing it to an accounting firm.

What Is Accounts Payable? What Is Its Role in Accounting?

Accounts payable refers to the management of short-term obligations that a business owes to its suppliers or vendors for goods or services received on credit. In simpler terms, this is a record of all invoices that have been issued but not yet paid. It is a common practice for companies in Malaysia to have a dedicated department responsible for managing such obligations or outsource to an accounting services provider.

The accounts payable process encompasses several critical functions in the accounting process and plays an important role in business operations. It involves receiving, verifying, and making payment for invoices accurately and on time, ensuring the payments adhere to the company’s policies. This prevents potential late fees, maintains strong vendor relationship, and helps avoid financial disruptions for the company. Strategic timing of payments for invoices also enables businesses to retain cash longer and improve liquidity, contributing to their overall financial stability.

How Does the Accounts Payable Process Generally Work?

Generally, when the accounts payable process is handled in-house in Malaysia, several key steps must be taken:

- Purchase Order (PO): A purchase order is submitted by a particular department of the company to procure the services or goods from the vendor.

- Receiving the Goods or Services: Upon receiving the goods or services from the vendor, the company verifies whether they match the PO. If accurate, a goods received note (GRN) will be sent to the vendor.

- Invoice Receipt: The vendor submits the invoice, which details the amount owed and due date, to the accounts payable department of the company.

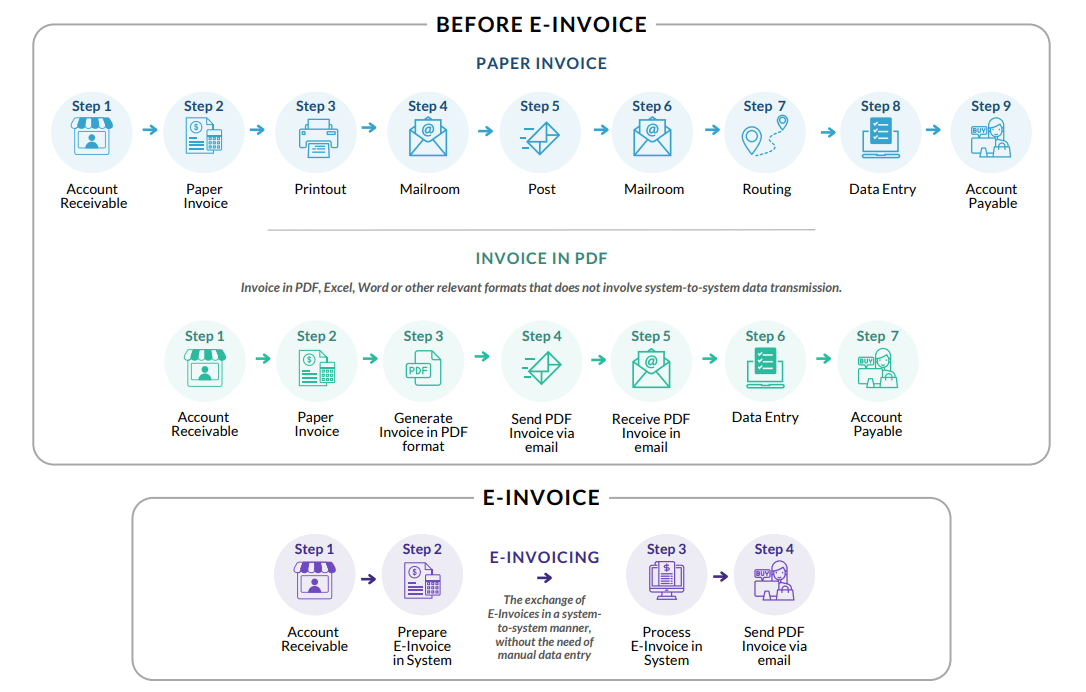

- Three-way matching: The accounts payable department compares the invoice against the PO and GRN to verify that there’s no discrepancy between these three documents, particularly in terms of the items or services received, quantities, and prices.

- Approval Process: Upon verification, the invoice is sent for approval to initiate the payment process. The payment method can be an electronic transfer, check, or other means.

- Record keeping: After the payment is finalised and processed, the data and details are input into the accounting system for tracking.

- Accounts Payable Reconciliation: The accounts payable department regularly reviews and examines any outstanding invoices and payment records against the statements from vendors and suppliers to ensure the overall accuracy of the balance.

How Does the Accounts Payable Process Work When Outsourced to an Accounting Firm?

Many companies outsource the accounts payable process to accounting firms in Malaysia. These service providers often consist of a team of experts with specialised resources and technologies to streamline the entire process for improved efficiency and ensure the practice is in compliance with relevant Malaysian regulations. Businesses can focus on their core operations without allocating extra costs to manage an in-house team, making outsourcing an ideal and cost-effective strategic choice.

Unlike how a company’s in-house team typically manages the accounts payable process, outsourced accounting firms or service providers operate differently with the following steps.

Initial Setup and Integration

Outsourced accounting firms generally start by conducting an initial assessment to learn about the needs of the company, such as the systems and processes required to handle the accounts payable functions. A new software may be implemented or integrated with existing systems to enable a streamlined accounts payable process.

Receipt, Processing, Matching, and Validation of Invoices

Handing the whole process from receipt, processing and matching to validating the invoices, the outsourced accounting firm typically utilises software throughout this step. Professional accounting firms like BoardRoom ultilises Optical Character Recognition (OCR) technology, where physical or digital invoice documents are scanned and converted into machine-readable data, automating the extraction of details like invoice numbers, amounts, dates, and vendor information. This significantly reduces manual data entry errors and speeds up the three-way matching process, improving efficiency and accuracy.

Workflow Management and Payment Approval

If no discrepancy is found or fraud risk is detected, the accounting firm route the invoice to the designated approvers based on predetermined thresholds and notify them for approval. Once approved, the accounting firm will start issuing payment vouchers, preparing cheques or initiating online payment to process the payment, ensuring timely remittance to the supplier.

Payment Documentation, Reporting, and Reconciliation

The accounting firm will document all payments made and record them in the client’s accounting system, which enables them to generate detailed reports and reconcile payments with bank statements. This is essential for maintaining accurate corporate financial records and supporting audits.

Consideration When Switching to Outsourced Accounting Provider

While an accounting firm can offer expertise and resources to ensure a smoother operation, businesses need to consider several crucial factors before outsourcing their accounts payable process to them:

- Ongoing Evaluation and Optimisation: The accounting firm should be able to continuously evaluate and optimise the accounts payable process to improve efficiency and reduce costs.

- Technology and Software: The firm should have access to advanced technology and software solutions that can streamline the accounts payable process and the approval workflow.

- Accuracy and Compliance: The firm should have a strong track record of accuracy and compliance with relevant regulations.

- Scalability: The firm should be able to scale its services to meet the changing needs of the business.

- Security: The firm should have robust security measures in place to protect sensitive financial information.

- Track Record: The firm should have a proven track record of success in providing accounts payable services.

Why Choose BoardRoom for Your Accounts Payable Needs?

As the leading provider of outsourced accounting services in Malaysia,BoardRoom can help you streamline your accounts payable process, improve efficiency, and reduce costs. Our experienced team of professional chartered accountants combines expertise with advanced technology to handle your accounts payable needs effectively. By partnering with BoardRoom, you can focus on your core business while we take care of your accounts payable. Contact us today for an assessment, and let us guide you through every step with our tailored solution.

Related Business Insights

-

26 Aug 2024

Mastering Payroll in Manufacturing Industry: Advanced Solutions for a Global Workforce

Simplify your payroll processing in manufacturing industry with BoardRoom’s real-time data processing and advance …

READ MORE -

08 Jul 2024

Guide to Filing Annual Returns in Malaysia

Ensure compliance and maintain your business's integrity in Malaysia with this guide on filing annual returns effic …

READ MORE -

24 May 2024

10 Advantages of Outsourcing Your Payroll Services

Explore the benefits of outsourcing payroll and discover how outsourced payroll providers like BoardRoom can stream …

READ MORE