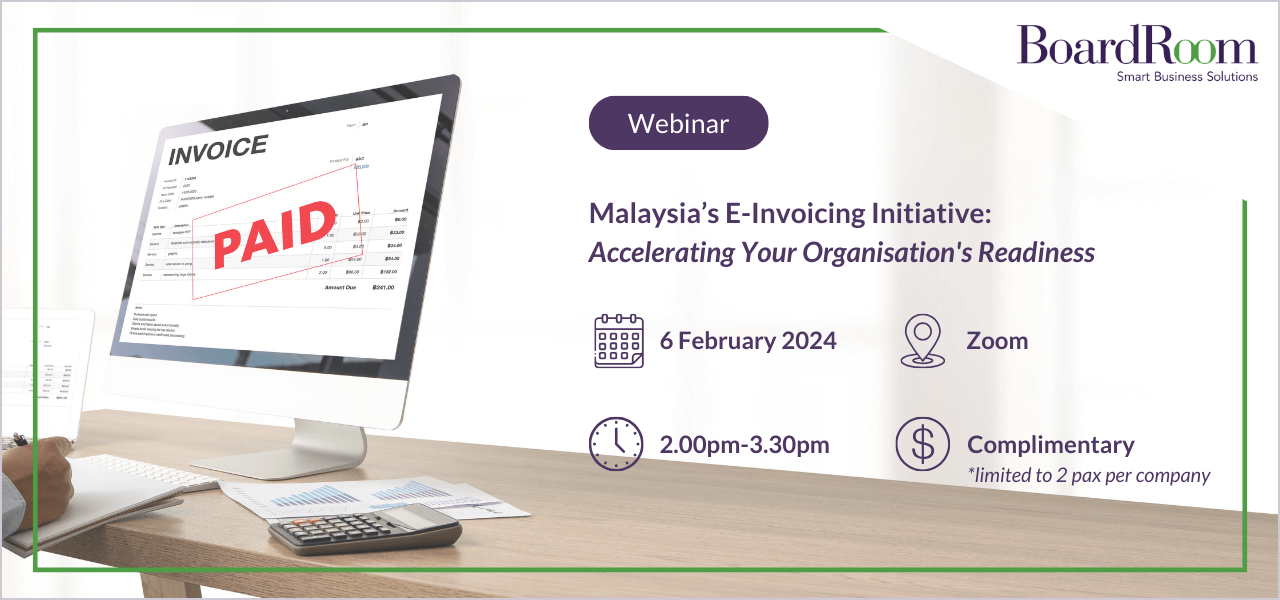

EVENT

Malaysia’s E-Invoicing Initiative: Accelerating Your Organisation’s Readiness

Companies in Malaysia with an annual turnover exceeding RM100 million are mandated to implement e-invoicing, starting from 1 August 2024. Subsequent phases affecting other businesses will follow, culminating in a comprehensive requirement for all Malaysian companies by July 2025.

In this webinar, our Accounting and Tax experts discussed essential information and provided actionable steps to guide companies through this transition.

Email our team today if you require assistance with your company’s e-invoicing matters.

Speakers

Cheong Woon Chee, Head of Tax Services, BoardRoom Malaysia

Woon Chee is a chartered accountant and tax advisor with more than 15 years of experience in providing tax advisory services concerning corporate & individual tax, partnership & foundation tax compliance, tax incentives, tax audits & due diligence. Her broad clientele includes construction companies, property developers, hotels, logistics firms, plantations, education institutions, manufacturing and food & beverages companies.

Yang Shuzhen, Director of Regional Accounting Services, BoardRoom Group

Shuzhen has over 17 years of professional experience, possessing extensive knowledge in the financial reporting requirements of various industries for both public listed and private limited companies. At Boardroom, she serves as the appointed subject matter expert for accounting and is actively engaged in the review of business models and costings, as well as development and review of business processes, financial policies, and procedures. She ensures compliance with statutory and regulatory requirements.

In her regional capacity, Shuzhen assists clients with both local and global reporting, managing internal stakeholder requirements, and overseeing local country statutory filings.