A comprehensive ESOP platform for all your needs

Our ESOP platform helps you streamline your ESOP processes, stay compliant with local regulatory requirements and ensure employee engagement.

Frequently Asked Questions (FAQs)

1. What is an employee stock option plan (ESOP)?

Employee Stock Ownership Plans or ESOPs in short, is one form of remuneration given to employees, by means of retaining them or to reward them based on their performance. An option serves as a right to acquire shares of a company at a predetermined price, or what we call an exercise price.

2. How do employee stock option plans (ESOP) work?

The function of an ESOP plan can be broken down into a five lifecycle stages which are Offer, Vesting, Exercise, Leaver and Lapse. An employee will firstly accept an option offering, whereby a fixed number of options will be allotted to them. After a certain timeframe, a proportion of the allotted options will vest, which means that these options can now be exercised.

To exercise these vested options, the employee will pay the total exercise cost (number of options x exercise price) and receive actual shares of the company thereafter. If they don’t exercise these vetsed options after the expiry date, these vested options will lapse or expire. If this happens, the participant can no longer exercise these options moving forward. If the employee leaves the company halfway through the ESOP lifecycle, in some cases, all of their vested and unvested options will lapse altogether, depending on the company’s ESOP rules.

3. What is an employee share plan (ESP)?

An employee share plan is a remuneration package, where employees are rewarded with ordinary shares in the company they are employed by. These share plans are usually offered as a form of remuneration in replacement of salary increases which can help benefit a company’s cash flow.

This plan is usually given to directors or upper level management, where the employee is rewarded with ordinary shares of the company, if they fulfill certain criteria or performance metrics set forth by the company. Initially, the participant (director or senior manager) will be allotted X number of restricted shares. At each vesting period (usually annually), a proportion of the allotted shares will be vested and become unrestricted shares, where the participant can then enjoy the benefits of owning an actual share (i.e. Sell, Voting Rights, Dividend Pay-out). The number of shares to be vested and turned into unrestricted shares, will depend on the participant’s performance during their evaluation period.

There are two main types of Employee Share Award Scheme (ESAS), namely a Performance Share Plan (PSP) and a Restricted Share Plan (RSP). Please visit our article for more detailed information on “What is an Employee Share Plan?”.

4. What are the key differences between an ESOP and ESP?

Cost

- For ESP, expenses need to be captured in the company’s accounting books even at point of grant.

- For ESOP, if the participants decide to exercise their options, they will have to bear the exercise cost. This means there’s cost savings to the company.

Company Profile

- For ESOP, it may be suitable for companies looking for fast growth, because participants only get to enjoy the benefits of their stock options when the market price is greater than the exercise price.

- For ESP, it may be suitable for companies looking for stable growth. Reason being, part of having an ordinary share is to reap the benefits of its dividends. And to do so, the company will have to ensure stable growth to ensure consistent payout of dividends.

5. Is ESOP beneficial for employees?

ESOPs are considered to be beneficial to both employees and shareholders.

This is because the system is designed to align the interests of employees and shareholders, as well as motivate employees by giving them ownership in their company, as well as considerable tax benefits.

When employees are rewarded with shares of the company, this means that they own a portion of the company. This allows employees to adopt an ownership style of thinking where their actions and decisions will be based on the greater good of the company in the long run.

6. How can BoardRoom help in ESOP and ESP services?

BoardRoom has been providing ESOP & ESP services to clients across APAC for years. We have a dedicated team of experts to guide you through all your implementation and administration needs. Our powerful digital platform, EmployeeServe, is completely flexible to your specific requirements because we recognise there is not a “one size fits all” solution to Share Plans.

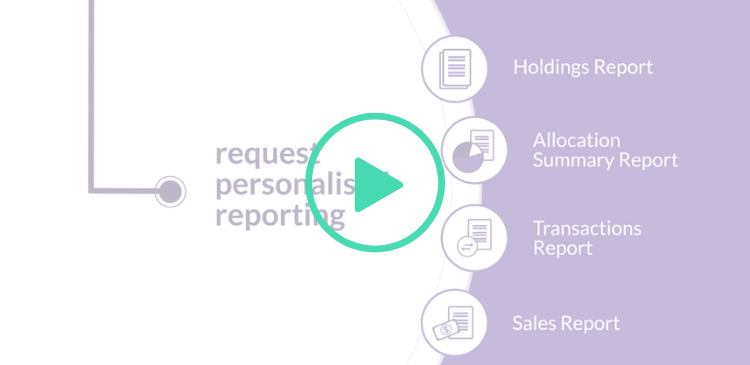

EmployeeServe allows participants to view, transact and manage their holdings as well as allowing the administration team to view participant holdings and generate insightful reports that will assist with their regulatory and management reporting. For more information on our ESOP services, please contact our professional ESOP consultants today