A comprehensive ESOP platform for all your needs

Effortlessly manage your ESOP processes, stay compliant to local regulations, and foster optimal employee engagement with our comprehensive ESOP platform.

Employee Stock Ownership Plan (ESOP)

No matter your business stage – start-ups seeking to attract talent, expanding companies rewarding their teams, or global organisations handling equity plans across multiple regions – we offer comprehensive solutions to simplify and improve the management of employee share plans.

Maximise the impact of your Employee Share Plans with our expert guidance and complete management services.

We can help with:

- Streamlined management of ESOPs, covering grant allocations, vesting schedules, and reporting for flawless accuracy and efficiency.

- Preparation of plan documentation, disclosures, and filings to meet all legal requirements.

- Specialised services to seamlessly manage employee share plans across regions, ensuring full compliance with local jurisdictional laws.

Our ESOP software is a versatile, fully integrated solution designed to meet the unique needs of your Employee Share Plans.

With our ESOP platform, you can:

- Empower employees with easy access to share information and plan participation through an intuitive, user-friendly interface.

- Leverage advanced tools to streamline ESOP administration, minimise HR’s manual efforts, and maintain effortless compliance with enhanced efficiency.

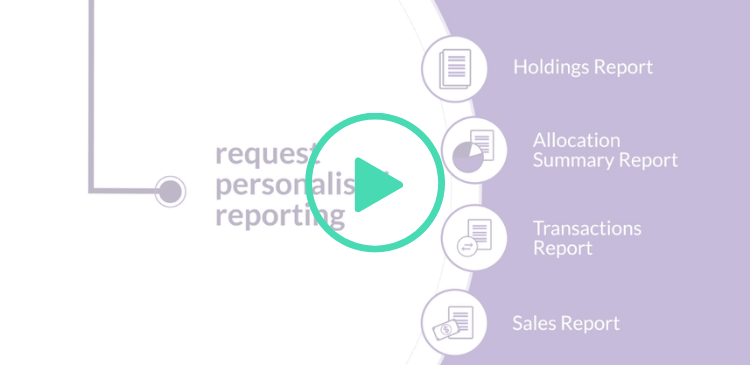

- Access detailed reporting and analytics to monitor plan performance and employee participation effectively.

We offer expert guidance and resources to ensure employees maximize the benefits of their Employee Share Plans.

Our services include:

- Delivering clear, engaging resouces to help employees understand how the plan works and its advantages.

- Providing easy access to comprehensive information and support through our intuitive, user-friendly platform.

Frequently Asked Questions (FAQs)

1. What is an employee stock ownership plan (ESOP)?

An Employee Stock Ownership Plan (ESOP) is a incentive plan that gives employees ownership in the company through shares of stock. Companies contribute stock to a trust, which holds it on behalf of employees, allowing them to benefit from the company’s success. Employees typically earn these shares over time through a vesting period and can sell them when they retire or leave the company. ESOPs align employee interests with company performance, motivate long-term commitment, and provide tax advantages for both the company and its employees.

2. What is an employee share option plan?

Employee Share Option Plans are a benefit plan or form of remuneration given to employees, which are directly related to the company’s stock shares. If an employee is part of an Employee Share Option Plan, it means they are able to acquire shares of the company in which they work at no upfront cost.

This type of benefit plan allows employees to achieve ownership interest, where they effectively transition from being not just employees of a company but also partial owners of it. This aligns the best interests of the employee with those of the company’s shareholders, encouraging them to contribute towards the company’s overall success as they will reap the financial rewards personally. Employee Share Option Plans also work by helping employees feel more appreciated and rewarded for their work.

3. How does an Employee Share Option Plan work?

Employee Share Option Plans are a way to offer employees shares for the company they work for. Employees can opt to buy a certain number of shares in the company by exercising their right to purchase the shares at a pre-determined price.

When a company incorporates an Employee Share Option Plan, the shares are allocated to each employee’s individual account, which are usually assigned based on the employee’s salary, years of service, or other factors. It is normal for new employees to complete at least one year of service before being able to join the plan. From there, the shares in an Employee Share Option Plan must be vested as the employee continues working for the company.

4. What are the benefits of an Employee Stock Ownership Plan (ESOP) for employees?

ESOPs are common in Malaysia and around the world and are considered highly beneficial for both shareholders and employees.

ESOPs are designed to align the goals of employees and shareholders and provide an incentive for the employee by giving them a vested interest in the success of the company through the shares they hold in it. This also results in higher employee engagement and involvement.

Each time employees are rewarded with shares of the company; it effectively means they own a small portion of it. If they own a part of the company, their actions directly impact the valuation of their shares. Overall, this yields positive results for the entire company.

5. How do I set up an employee stock ownership plan (ESOP)?

There is no one-size-fits-all solution when it comes to employee stock ownership plans, so it is vital to have a clear vision of what you want to achieve from it. Different types of plans have pros and cons, depending on the size, scale, and ambitions of your business.

The best way to get a tailored and bespoke plan for your business is to get in touch with our specialists here at BoardRoom. Together with our in-house software and decades of experience, we can help you to develop and administer an employee share plan that is beneficial for both your employees and shareholders.

6. What happens when an employee who is part of an ESOP leaves the company?

When an employee leaves the company, they should receive the vested portion of their ESOP. Any unvested stock becomes invalid. However, this is also based on factors such as your tenure at the company.

7. What is an employee share award scheme (ESAS)?

Share award schemes are when a company gives their employees shares, as opposed to share options. As part of their income, a share award scheme counts as taxable income.

8. Why do companies adopt ESOP, ESOS or share award schemes?

Companies often choose to adopt an ESOP, ESOS or share award schemes as a way to align the employee’s interests with that of the shareholders. By giving employees the opportunity to co-own a small part of the company, the success of the company has a direct impact on their income. Additionally, these plans are a great way to increase employee retention.

9. How can BoardRoom help with Employee Share Ownership Scheme (ESOP) services?

BoardRoom has been offering bespoke ESOP services to clients across Malaysia and APAC for years, recognising the importance of boosting employee morale and motivation. Our team of specialists will guide you and your company through each step of its implementation while our digital platform, EmployeeServe, can be modified to fit your business needs.

EmployeeServe allows all those participating in the plan to view and manage their holdings, and the admin team to generate insightful reports and manage the scheme.

For more information on our employee share plan services or to kickstart your company’s plans, please get in touch with a member of our team.