On 29th October 2021, Malaysia’s 2022 Budget, themed “Keluarga Malaysia, Makmur Sejahtera”, was tabled by Finance Minister Tengku Datuk Seri Utama Zafrul bin Tengku Abdul with a wide range of tax incentives offered to both individuals and corporates. The expansionary budget is aimed to act as a catalyst to boost economic recovery and close the gap on the country’s fiscal deficit.

If you have any questions relating to any of the information contained in this report or need tax consultancy services, please email our tax advisors via [email protected] or call us at +60 3 7890 4500.

Individual Tax Relief

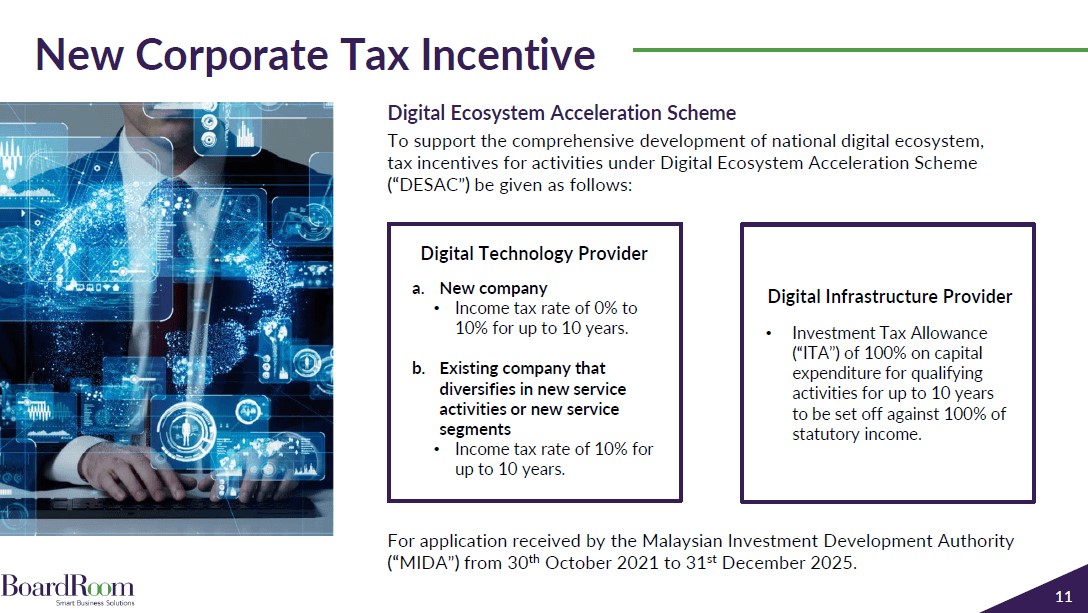

New Corporate Tax Incentive

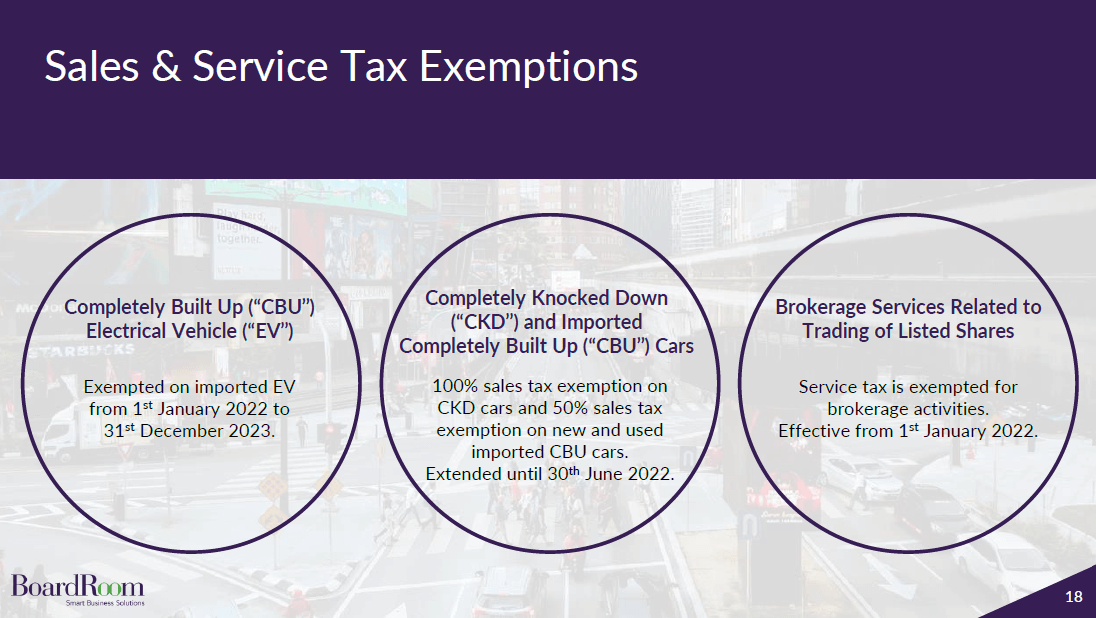

New Sales & Service Tax Exemptions

Related Business Insights

-

01 Nov 2025

Corporate Tax in Malaysia: Turning Annual Tax Returns and Pre-Planning into a Strategic Advantage

Understanding corporate tax in Malaysia is key to smarter business decisions. Strategic planning can turn tax compl …

READ MORE -

30 Oct 2025

Malaysia’s Budget 2026: Key Tax Highlights for Businesses and Individuals

On 10 October 2025, Prime Minister Datuk Seri Anwar Ibrahim tabled Malaysia’s Fourth MADANI Budget: A Budget for …

READ MORE -

07 Oct 2025

Employee Statutory Contributions: EPF, SOCSO, EIS & HRD

Learn how to manage Malaysia's statutory contributions, EPF, SOCSO, EIS & HRD, with clear guidance on compliance, b …

READ MORE