5 ways that outsourcing your accounting function can boost your company’s financial health

“Essential but not efficient”…

If that sounds like an accurate description of your company’s accounting function, it might be time to consider outsourcing to a specialist accounting services provider.

Not only will you gain more time to focus on business growth, but it can also be a more efficient use of your company’s resources. Perhaps the idea of outsourcing your accounting, tax and bookkeeping responsibilities sounds appealing, but you wonder how to make it work for your company’s unique needs.

If so, this article will take you through the top five ways that outsourcing your accounting function can boost your company’s financial health.

What is Outsourced Accounting?

Outsourced Accounting is when an organisation chooses to use an accounting service provider to manage the accounting and financial functions of its business. By outsourcing these functions, the business reduces the need for an in-house accounting department and allows these owners to focus on their business.

Accounting firms offer a variety of services, which may include bookkeeping, financial reporting, management accounting, tax preparation, accounts payable and receivable, debt collection, cashflow management and reporting, and other related services such as payroll processing. Whether you need a short-term solution or a permanent resolution, outsourcing your accounting is an effective go-to option infast-moving business environments such as Hong Kong.

The outsourced accounting firm takes on the day-to-day accounting tasks and ensures that financial records are accurate, compliant with regulations, and up-to-date. They may use accounting software and systems to streamline processes, automate tasks, and provide timely financial information and reports to the client.

Who is Outsourced Accounting for?

With advancements in technology and remote work capabilities, companies of all sizes can benefit from outsourcing accounting.

Smaller businesses, growing companies and not-for-profit organisations may consider outsourcing their accounting. It allows them to access specialised expertise, reduce overhead costs, ensure compliance, and focus on their core competencies while leaving their accounting needs in the hands of experienced professionals.

In addition, business owners who require temporary accounting help can consider outsourcing their accounting. Services that can be outsourced can range from accounting audits or end-of-year reporting for these cases.

Regardless of your organisation’s size, outsourcing your accounting functions can offload these tasks to professionals in the field and benefit from cost savings, access to expertise, improved efficiency, and scalability.

01 Get access to expert accountants without increasing salary expenses

Instead of accumulating overheads with an in-house accounting team, you will create cost savings by outsourcing to an expert services provider.

This gives you access to a team of accounting professionals without needing to spend on recruitment, training, wages or employee benefits.

Our team of professional chartered accountants at BoardRoom can streamline your accounting function while ensuring you meet all of your compliance obligations.

02 Gain clearer insights to support your business growth

Outsourcing to a credible accounting firm can help you better understand your company’s receivables, credits and collections. This, in turn, can generate a clear picture of your cash flow and revenue seasonality.

Understanding this information can then create clarity around your company’s overall financial health, providing greater insights into specific areas of growth potential. As an end result, you can make smarter, more informed decisions about your company’s future direction.

For example, those newfound insights might suggest that the time is right to open another local or overseas branch or hire some new employees. In either case, as the leading corporate and advisory services provider in the Asia-Pacific Region, the BoardRoom team can help:

- Our setup and incorporation experts can help you to establish a new branch, either locally or across the region, including in Singapore, Malaysia or Australia.

- Our payroll experts can assist you in automating your company’s payroll management to more effectively manage your human capital.

03 Avoid costly penalties by staying compliant

Running a large, multi-national company can be time-consuming and expensive. As your company grows, so too does the complexity of your tax reporting obligations. The last thing you want is to be in breach of the Hong Kong Inland Revenue Department’s (IRD’s) compliance requirements. At best, that may result in an audit. At worst, you could incur significant financial penalties.

For example, failing to meet your tax filing obligations can result in costly penalties. If you mistakenly leave some tax unpaid in Hong Kong, the IRD considers the outstanding amount to be a tax default. As such, it will take recovery actions and add a 5% surcharge onto the unpaid tax balance. The second instalment will then be due immediately if the first instalment is late. After six months, the IRD will impose an additional 10% surcharge on any outstanding balance.

However, a professional firm like BoardRoom is well-versed in tax law compliance. Outsourcing your accounting function to our team of taxation specialists can help your company to avoid any costly pitfalls.

04 Maximise savings with the tax breaks your company is entitled to

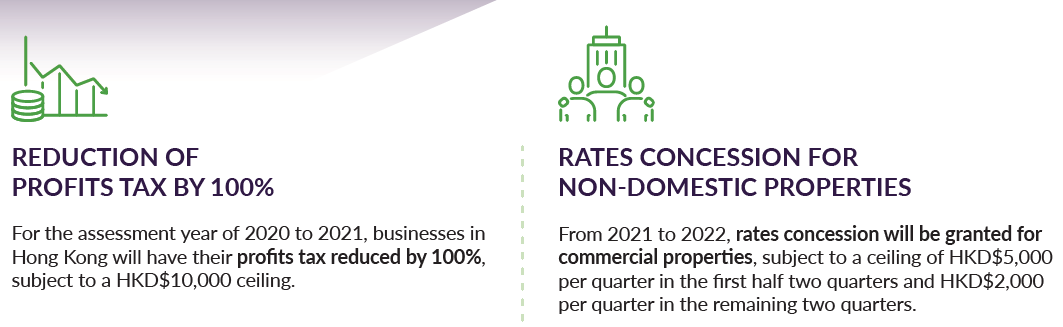

Your company is probably entitled to several tax breaks, but you may not be aware of all of them, they are also ever-changing so it can be hard to stay up-to-date. For example, businesses in Hong Kong with an annual profit of less than HK$ 2,000,000 need only pay a tax of 8.25%. That is half the regular corporate tax rate.

The IRD also released several business tax measures in its 2021-22 budget, including profit tax reductions and registration fee waivers. Hong Kong has signed a number of double tax treaties, the benefits to Hong Kong companies are numerous.

Read more about the Hong Kong Budget 2021-22 Report

Tax experts at a specialist accounting services provider like BoardRoom can help you to take advantage of all of these tax breaks – and more – while staying compliant. Our team will also go the extra mile and apply for any tax incentives that could benefit your company.

05 Increase efficiency with an organised, automated accounting flow

To increase efficiency, your company must have digital accounting records. This makes your data easier to analyse, which can help you to identify more insights into the most profitable areas of your business to drive growth.

Our team of professional accountants at BoardRoom can set up a secure, cloud-based financial management system for your company. We can also integrate payroll and claims submissions into the platform to further streamline your accounting flow and improve efficiency.

How Boardroom's expert accounting services can boost your company’s financial health

Accurate, reliable accounting is at the core of every successful company in Hong Kong. However, outsourcing your accounting function to expert service providers like BoardRoom removes the need for an in-house team. This helps you to save on employee overheads while still maintaining access to a professional team of chartered accountants.

To maximise your company’s financial health, our accounting experts will help you to:

- stay compliant;

- maximise your tax benefits;

- keep you organised; and

- offer you clearer insights into your company’s growth potential.

Get in touch with our professional chartered accountant team today to learn more about our accounting services and how they can help to boost your company’s financial health.