The past few years have seen dramatic changes occurring across the globe. Business operating models have evolved. The regulatory landscape has become stricter, and most organisations have shifted to hybrid working models.

These changes have all had a profound impact on payroll. Organisations are under more pressure than ever to deliver accurate, timely payroll services while still complying with changing regulations.

This is leading many businesses to rethink how they manage their payroll function. Two common efficiency-boosting options for companies in Singapore are payroll software or outsourcing payroll. But which option is most suited to your company’s requirements?

Both methods offer advantages, which can make it difficult to evaluate the one that is best for you. Plus, the number of payroll software options in Singapore seems to be limitless, increasing decision complexity.

The right option for you will depend on several factors, including your company’s:

- size;

- growth strategies;

- compliance requirements; and

- operating model.

To help simplify the decision process, this article explores both payroll outsourcing and payroll software in Singapore, and provides guidance on deciding which model is right for you.

What is outsourced payroll?

Outsourcing payroll involves hiring a specialist payroll company to handle some, or all, of your payroll functions. An outsourced payroll provider usually offers a wide range of services, so businesses can choose the options that best suit their specific needs.

Some typical services that payroll outsourcing providers in Singapore offer include:

- computing gross to net salary and CPF;

- providing payroll detail, variance reports and payroll journals;

- disbursing net salary and CPF via bank accounts, and issuing confidential payslips;

- preparing year-end IR8A forms and appendices;

- preparing IR21, GML, NS MUP, CPF refund, government statistics forms, etc. per the Singapore Employment Act; and

- electronically administering employee leave and expense claims.

Outsourcing payroll is a well-documented way to improve HR efficiency and reduce costs. Additionally, outsourcing your payroll function can help you to:

- Save time: outsourcing your payroll enables you to keep managing your core business operations without having to maintain staff to handle day-to-day payroll functions in-house.

- Increase cost visibility: one of the major benefits of outsourcing is the ability to limit cost fluctuations. You maintain complete visibility over how much you spend each month. And because any additional hires come at a pre-determined rate, you can more easily plan hiring costs.

- Easily maintain compliance: an outsourced payroll specialist should maintain a team of experts with experience in payroll regulations. This significantly lowers your risk of financial penalties for non-compliance.

- Increase productivity: handing over your payroll processing reduces the administrative burden on your team, freeing them up to focus on growth and profitability.

- Enhance security: in a world rife with data security breaches, reputable outsourced payroll providers offer multiple servers, backups and other security systems and processes. These features protect employees’ sensitive personal data and grant you peace of mind as an employer. Additionally, outsourced payroll providers should have robust internal processes that comply with rapidly changing best practices around personal data protection rules.

What is payroll software?

While many companies in Singapore outsource their payroll function, others choose to implement some form of dedicated payroll software. Compared with manual processes like Excel spreadsheets or paper records, these options streamline your payroll process and offer the opportunity to automate certain aspects.

Of course, you still need people – usually your internal HR or finance team – to input wages and hours worked into the software. But once it has the data, the software uses it to automatically perform calculations, deduct withholdings and execute routine payroll tasks.

As mentioned earlier, companies have many options when it comes to payroll software in Singapore, and benefits can vary extensively between them.

However, a high-quality payroll solution can help your company to:

- Greatly reduce the chance of human error: a payroll system can automatically calculate bonuses, expenses, holiday pay, etc. with minimum effort. Compared to someone manually entering data into a spreadsheet or system, this can significantly reduce errors.

- Automate processes: a payroll solution helps to save time and resources by automatically performing manual processes such as generating payslips and year-end reporting.

- Secure data: reliable payroll software encrypts data and saves it securely on dedicated cloud-based servers.

- Save time: moving from manual payroll processes to a payroll software system can reduce the need for team members to perform many time-consuming tasks.

- Gain insights: modern payroll platforms provide real-time reporting capabilities, efficiently streamlining payroll reporting compared to clunky legacy systems.

Which is right for you? Two important factors to consider

There are as many advantages of outsourcing payroll services as there are of using SaaS (software as a service) payroll software. The right option is an individual decision that depends on a variety of factors.

However, we recommend focusing on two considerations as you weigh up your options.

1. Your company size and growth trajectory

Payroll software can provide a simple, straightforward payroll processing solution, which can be particularly appealing for smaller companies and start-ups. Purchasing payroll software and employing someone to manage it can also be a cost-effective way to manage payroll in-house.

Beyond this, you can typically maintain greater control over in-house payroll processes and management, since you can dictate your own process and then change it when required.

However, as your business grows, so does your payroll complexity.

If your internal teams are already stretched to the limit, asking them to manage payroll can present a real challenge. You know that a late pay run can result in unhappy employees. You also know that a rushed pay run may have errors. The last thing you want is for a simple payroll mistake to generate costly fines or lawsuits.

Additionally, if your staff numbers are increasing, a good payroll outsourcing provider can help you to keep up with the changes. Partnering with them early in your expansion journey also enables them to get to know the ins and outs of your company as you grow.

As a bonus, they may also be able to advise on and help coordinate other aspects of your business such as tax, accounting, corporate secretarial and employee share plan services.

2. Your regional footprint

The past year has demonstrated that given the right tools and technology, employees can successfully work from (almost) anywhere. However, this flexibility means you’ll need to consider a payroll option that factors in the new remote nature of work.

Because SaaS payroll platforms are hosted in the cloud, accessibility is a major benefit.

SaaS payroll platforms also give you access to information anywhere there is an internet connection, so your payroll staff can work from any location. And if the software offers self-service tools for your employees, such as accessing payslips or logging leave, they can use these remotely as well.

However, companies that operate across borders will need an international payroll solution to ensure they correctly pay their people in multiple locations. Consider a payroll platform that can handle multi-currency pay runs, so no matter where your people are, you can pay them on time, in the correct currency.

Flexibility may not equal simplicity

While remote working is wonderful for employees who want more flexibility in their lives, it has caused more complexity for payroll teams.

According to EY’s 2022 Global Payroll Survey, remote working policies and their impact on multi-jurisdictional payroll withholding is the number one payroll consideration resulting from the pandemic.

Payroll legislation also changes frequently, so keeping up with new regulations takes time and sometimes specialist knowledge. If you are managing payroll in-house, you will need someone to stay on top of Singapore’s local regulations and update your payroll system accordingly to ensure you remain compliant.

Similarly, if you choose to outsource your payroll, it’s worth checking in advance whether your provider has people with the right local knowledge to navigate the changing landscape.

Regional payroll takes specialist knowledge

If your organisation is expanding across the Asia-Pacific region, compliance tends to get complicated.

For example, companies operating in markets with complex labour laws and regulations, such as Malaysia and China, might lack access to local expert knowledge. Without this specialist knowledge, they may struggle to operate with peace of mind.

This is where an outsourced payroll provider can really add value.

Outsourcing payroll to a reliable vendor can reduce the burden of worrying about fines or potential lawsuits due to misunderstanding complicated payroll requirements.

Handing over your payroll management to a trusted third party enables you to redirect your HR team’s resources into other business-generating activities. They can spend less time becoming familiar with the different laws across each country in which you operate – and more time focused on strategy or revenue building.

Finding a trusted payroll partner

If you know you need help with your payroll function, it’s worth choosing a partner with experience in, and knowledge of, both outsourcing and payroll software.

Not only can they advise you on the best solution for you, but they can also help you to adapt your payroll strategy as your company’s needs change – perhaps as you:

- grow your headcount;

- expand into other countries within Asia-Pacific; or

- move to an incorporated company structure.

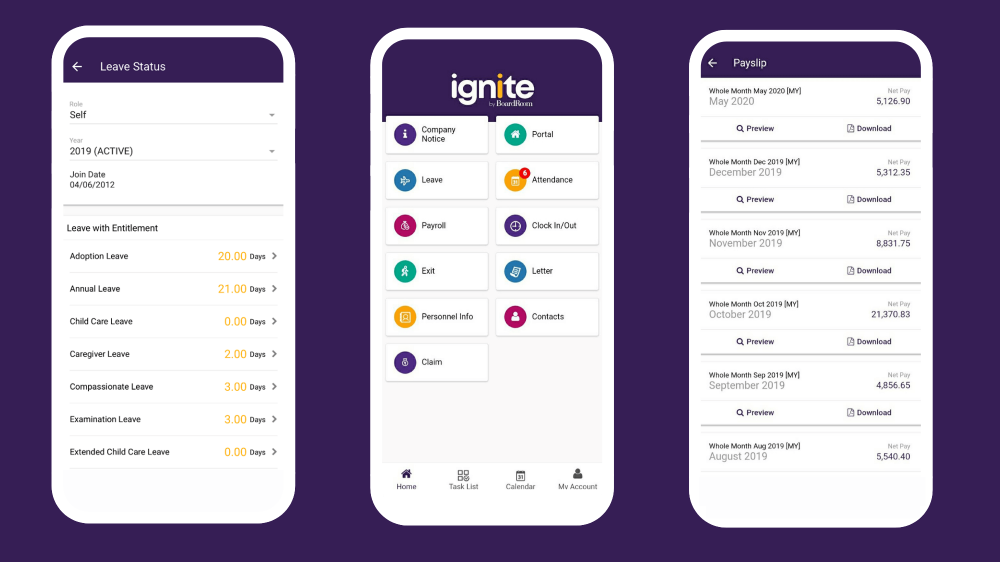

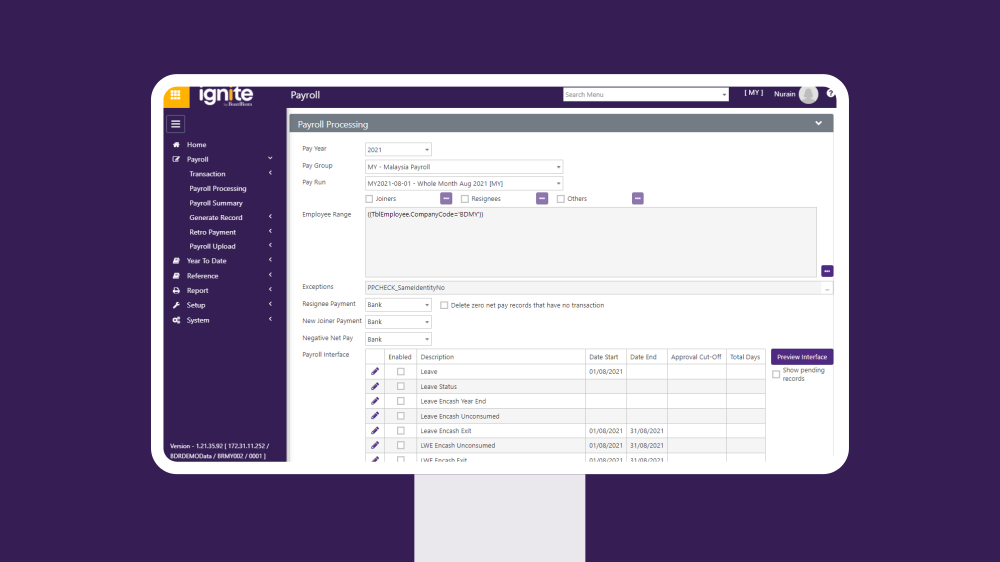

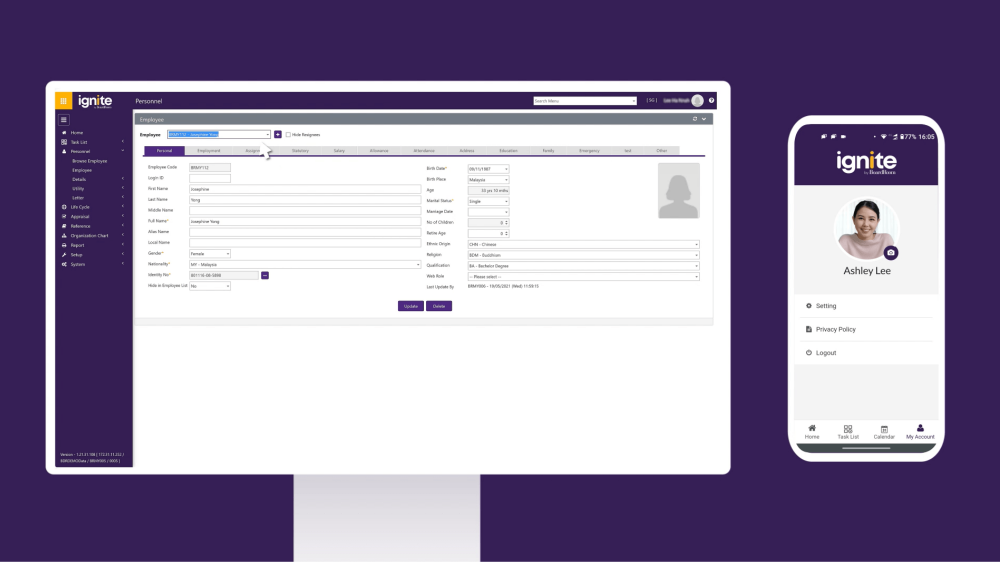

At BoardRoom, we offer both payroll outsourcing services and an all-in-one cloud-based HRMS payroll solution, Ignite. Ignite helps to boost the efficiency of your regional payroll processing, giving your leaders more control and foresight for future planning.

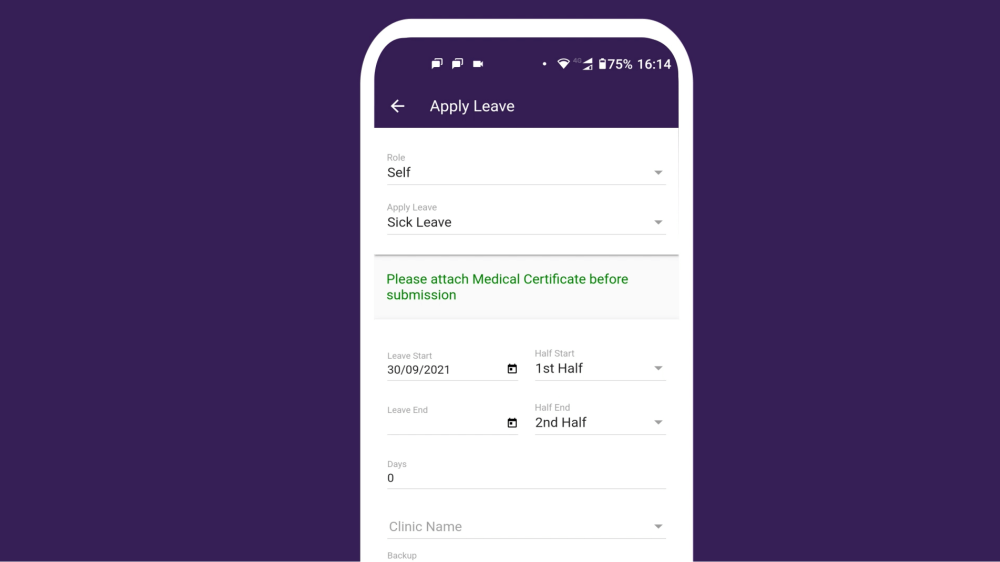

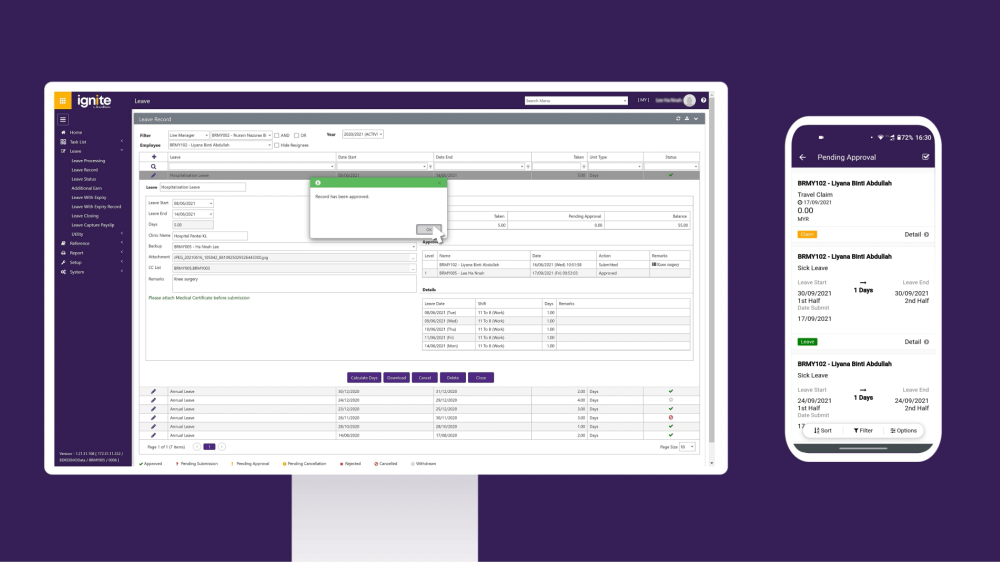

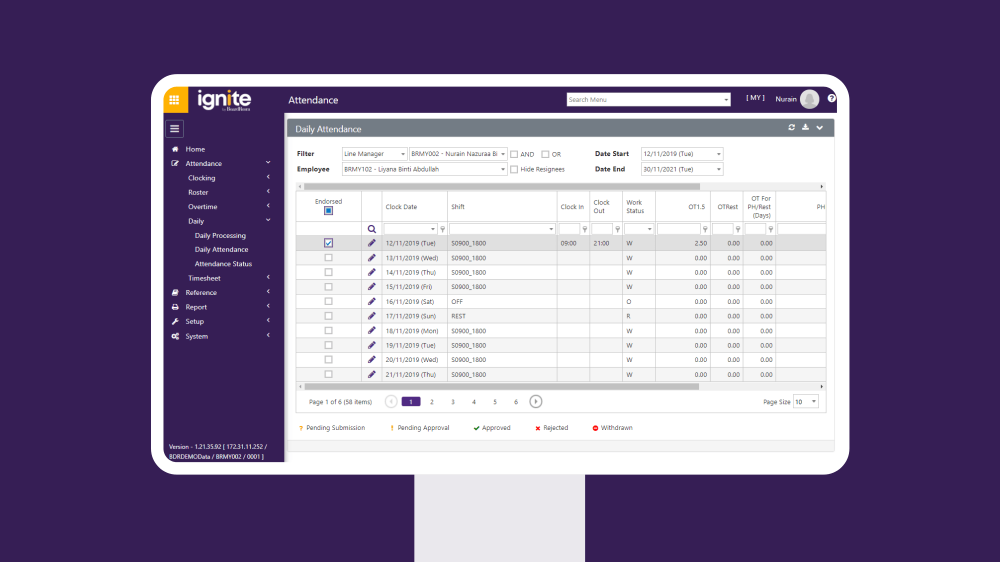

Ignite offers:

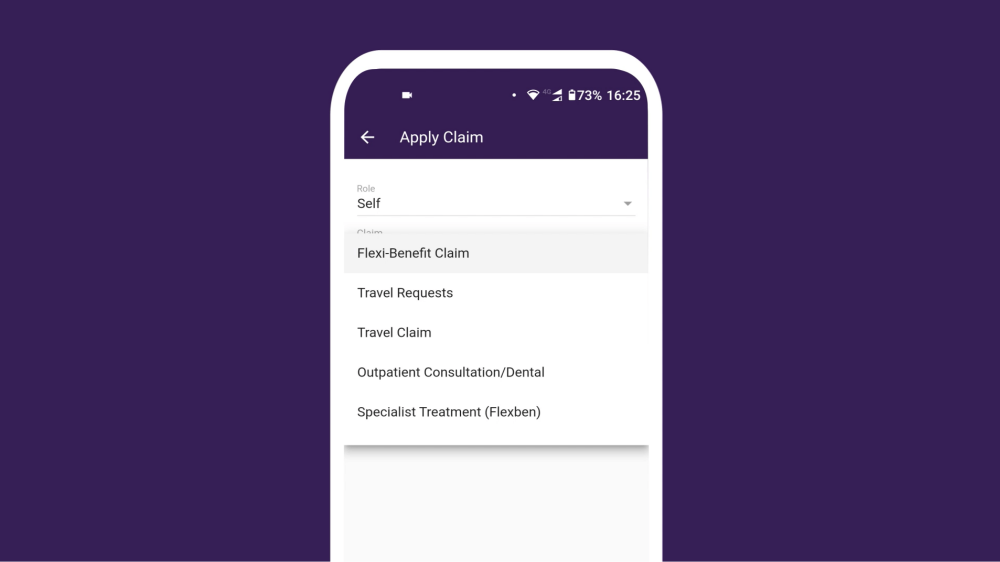

- a complete HRMS solution with multi-country payroll, leave and claims processing;

- full statutory compliance with local legislation in nine countries across Asia;

- a flexible automated leave solution and automated payroll processing;

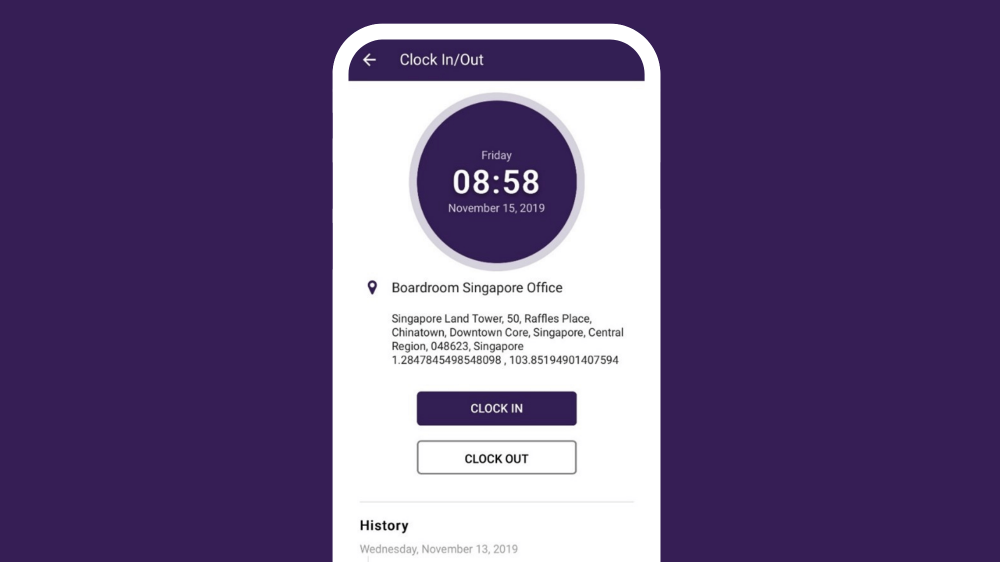

- an intuitive mobile app for instant employee access to payslips, claims and leave application and submission;

- attendance-clocking technologies, a shift calendar and a staff rostering system; and

- a dedicated account manager who provides one easy point of contact.

I still can’t decide. Can my company use both?

Many of our BoardRoom clients use a combination of the two solutions. They might initially come to us needing payroll software; but then as they grow and expand, they decide to outsource their payroll to us.

A trusted corporate services provider can guide you on best practices and identify key risks and potential problems. They can also provide practical solutions that save your team time and resources – not to mention, helping you to avoid costly non-compliance issues.

And the benefit of partnering with a trusted full-service provider like BoardRoom is that we can handle other aspects of your business such as:

- accounting;

- tax;

- corporate secretarial;

- company incorporation;

- share registry services;

- employee stock option plans.

Our centralised services offer assistance in multiple fields, providing access to in-depth knowledge of local payroll legislation across the region while also streamlining your outsourcing processes. And you only ever deal with one point of contact, no matter how many jurisdictions you operate in.

That makes your work life – not just your payroll processes – simple and painless.

Speak to our payroll specialists today about how we can help streamline payroll services for your company.

Related Business Insights

-

05 Apr 2024

What Are the Key Benefits of Outsourcing Accounting Services?

Explore the advantages of engaging BoardRoom’s accountancy services, a leading accounting firm offering tailored …

READ MORE -

05 Apr 2024

What Factors Should Businesses Consider When Choosing the Right Accounting Firm?

Explore key factors for choosing the right accounting firm. Partner with BoardRoom for the best financial managemen …

READ MORE -

22 Mar 2024

ESG Reporting Essentials – Your Guide to ESG Reporting in Singapore

Boost transparency and build trust with comprehensive sustainability tracking and ESG reporting solutions. …

READ MORE