In 2025, the business process outsourcing (BPO) sector is experiencing a transformational surge. Fuelled by economic pressures, technological innovation and the need for strategic agility, outsourcing has evolved from a tactical cost-cutting move into a core growth enabler for global enterprises. According to Acumen Research and Consulting, the global BPO market is projected to hit USD 512.4 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.9% from 2022.

While North America holds the largest share of the BPO market, Asia-Pacific (APAC) is quickly emerging as the fastest-growing hub, thanks to its deep talent pools, multilingual workforce and expanding digital infrastructure. Within APAC, Singapore has cemented its status as a regional outsourcing powerhouse, offering an ideal blend of business-friendly regulations, innovation-driven policies and regional accessibility.

Understanding the key trends shaping BPO – plus their benefits and potential risks – will help CFOs, COOs, HR leaders and other decision-makers make informed choices that enhance scalability, ensure compliance and strengthen their competitive edge in 2025 and beyond.

What’s Driving the Growth in Business Process Outsourcing?

As businesses navigate shifting markets and rising demands, outsourcing is no longer just a cost-cutting measure; it’s becoming a core strategy for growth.

The following forces are driving the rapid expansion of BPO worldwide, shaping the key factors behind its momentum heading into 2025:

Economic uncertainty and cost pressures

Ongoing global uncertainty, rising labour costs and inflation are prompting companies to reassess cost structures. Outsourcing offers a more flexible cost model by converting fixed costs into variable ones while still delivering quality services.

Need for operational scalability and expertise

Businesses increasingly require access to domain specialists without the overhead of building internal teams. Whether for finance, tax, payroll or IT, outsourcing provides instant scalability and access to experts, especially in highly regulated or fast-changing industries.

Digital transformation and remote work

The acceleration of AI, automation and cloud technologies is redefining how services are delivered. Remote work has proven that geography is less of a constraint, allowing organisations to engage service providers across borders with minimal disruption.

APAC’s strategic advantage

APAC’s BPO market is expanding at the fastest compound annual growth rate globally, with Singapore leading the way. The city-state offers advanced infrastructure, a tech-savvy workforce and a central time zone that supports 24/7 operations across Asia and beyond.

Top Business Process Outsourcing Trends to Watch in 2025

With these factors fueling the rapid rise of outsourcing, the market’s growth shows no sign of slowing. Here are the top outsourcing trends for 2025:

Gone are the days when businesses outsourced only bookkeeping, accounts payable or accounts receivable. Companies are increasingly entrusting their entire finance function – including accounting, statutory reporting and tax advisory – to external providers. This trend supports better financial planning, forecasting and risk management, particularly for companies expanding across borders.

HR outsourcing has evolved beyond basic payroll processing. In 2025, there is strong demand for services such as recruitment process outsourcing (RPO), cross-border payroll administration, onboarding and employee self-service portals. Providers like BoardRoom deliver fully managed payroll solutions across 19 APAC markets, with built-in compliance and customisation.

IT outsourcing continues to surge, particularly in cybersecurity, cloud infrastructure management and AI/automation support. As hybrid work models persist, businesses require secure, scalable IT support. According to rethinkCX, more than 50% of BPO vendors now use AI in client support environments, handling up to 80% of routine enquiries.

Tailored BPO offerings for niche sectors like fintech, healthcare and logistics are growing in popularity. These providers bring deep regulatory and operational knowledge, enabling more effective service delivery. For example, healthcare BPO partners manage everything from patient billing to telehealth scheduling.

In 2025, businesses are seeking outcome-based partnerships rather than transactional service agreements. This means BPO contracts now include service-level expectations tied to metrics like Net Promoter Score (NPS), First Call Resolution (FCR) and even ESG alignment.

Sustainability is no longer optional. A Deloitte study found that 40% of companies now favour outsourcing vendors with strong environmental, social and governance (ESG) credentials. Green data centres, paperless processes and diversity in staffing are now factors in vendor selection

The Benefits and Potential Risks of Outsourcing — and How to Navigate Them

Though outsourcing can drive growth, there are a range of potential challenges. Understanding both the advantages and possible risks helps business leaders make confident decisions and build strong, reliable partnerships.

The benefits are clear. Outsourcing reduces overheads by converting fixed costs into variable expenses while providing immediate access to specialised expertise in payroll, accounting, tax and compliance. It also enables rapid scaling of operations and supports faster market entry, particularly when expanding into new regions.

Conversely, risks such as data security breaches, regulatory non-compliance or unreliable service delivery can disrupt operations if they are not properly managed.

Choosing the right service provider can minimise these risks. Look for well-defined service level agreements, ongoing due diligence and providers with proven local and cross-border expertise. With the right safeguards, outsourcing remains a strategic lever for growth and operational flexibility.

How BoardRoom Helps You Outsource with Confidence

As one of APAC’s leading corporate services providers, the One BoardRoom Advantage offers businesses end-to-end outsourcing solutions backed by regional expertise, award-winning technology and a 50-year legacy of trust. These include:

BoardRoom can facilitate a seamless market entry into Singapore with end-to-end company registration and incorporation services. We assist with entity selection, name reservation, nominee directors and post-incorporation compliance. Our fast turnaround and in-depth tax structuring advice help businesses establish a compliant presence efficiently and effectively.

Across all services, clients have access to a dedicated account manager, providing a single point of contact for streamlined communication and quick response times. We combine local insights with regional scale, helping businesses navigate multi-jurisdictional complexity with confidence and clarity.

BoardRoom’s Ignite payroll platform supports companies across 19 countries. It is a fully compliant, secure, cloud-based system with integrated leave and claims modules. BoardRoom maintains ISO 27001 and SOC 2 certifications, ensuring enterprise-grade security. It boasts a 24-hour SLA response rate and supports more than 500 clients in the region.

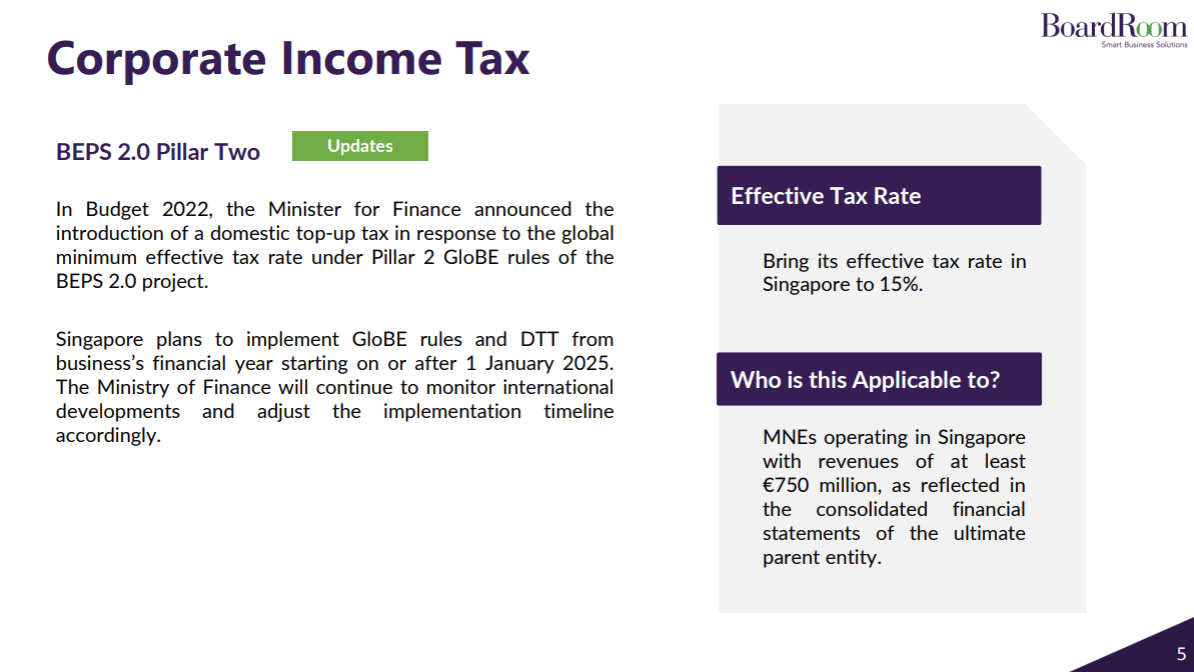

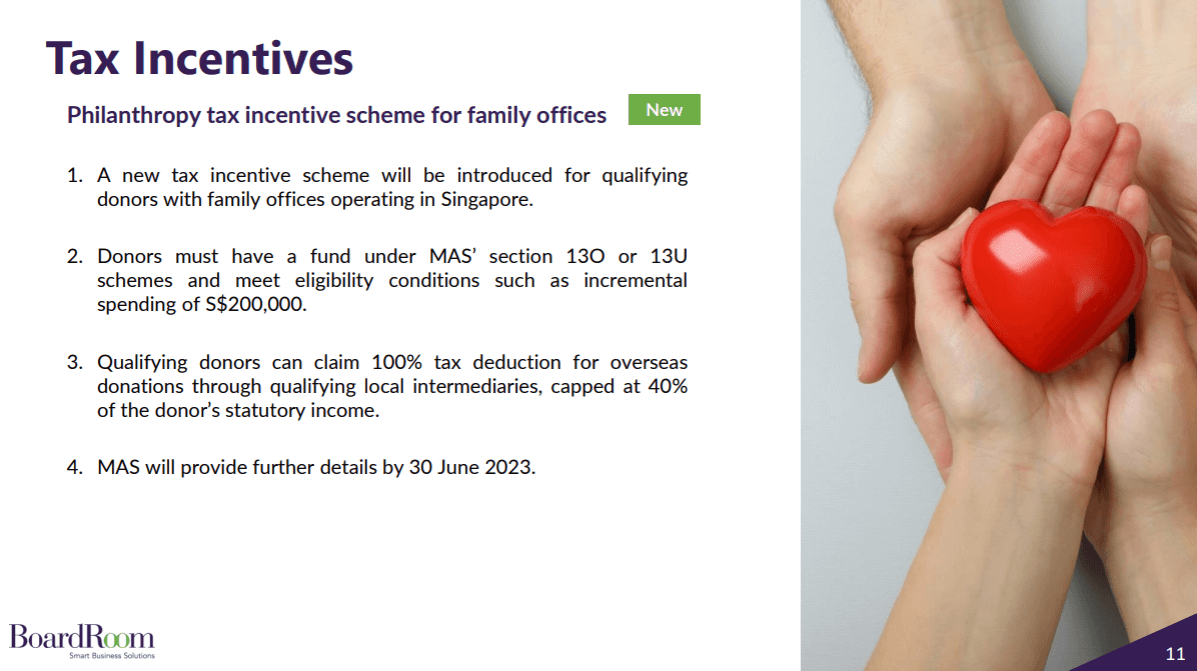

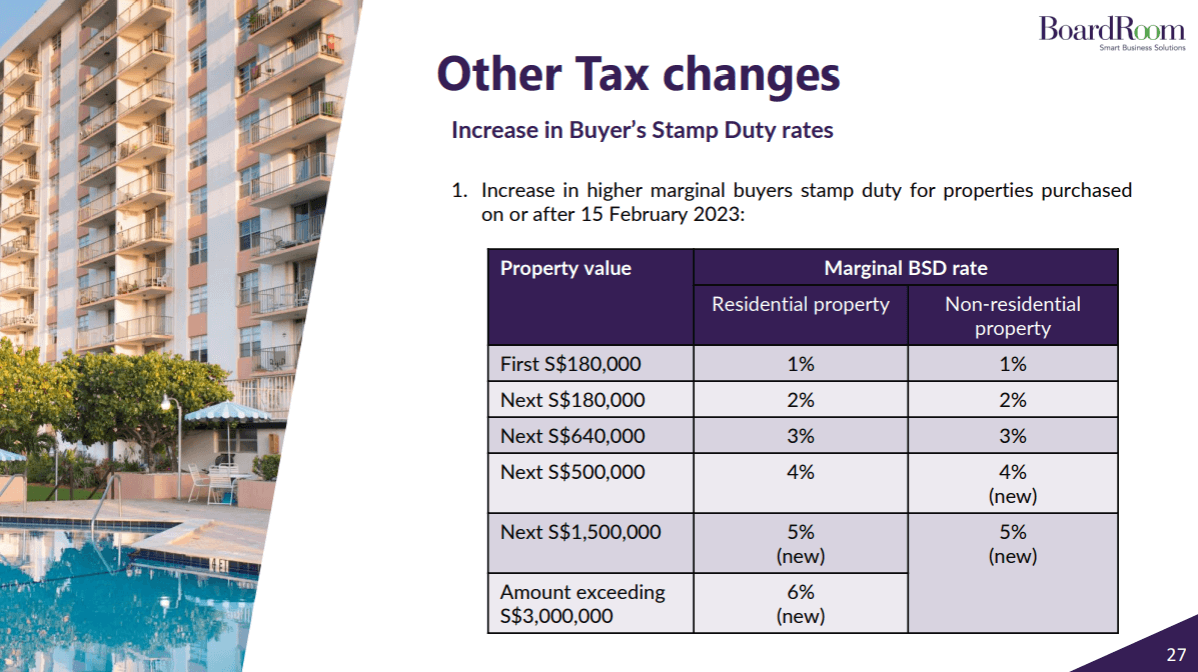

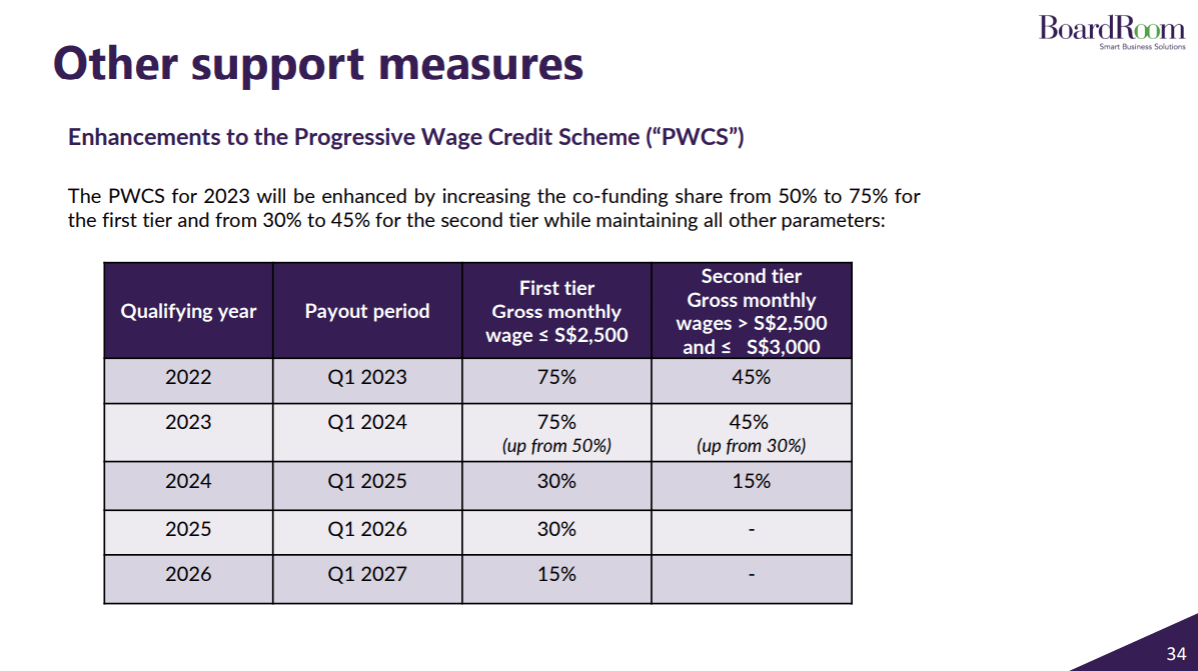

BoardRoom’s tax advisory and filing services help clients navigate complex Singapore and regional tax regulations, including GST, transfer pricing, corporate income tax and withholding tax. Services include tax health checks, due diligence, investment advisory and cross-border structuring. Our proactive approach ensures clients capture all eligible tax incentives and exemptions.

BoardRoom’s accounting and bookkeeping services are reliable and accurate. With Xero Platinum Partner status, we provide advanced management and statutory reporting, group consolidation and financial year-end statement preparation. Clients, especially those operating across multiple jurisdictions, benefit from strategic cashflow insights and reduced compliance overheads.

With deep experience in Singapore’s Companies Act and regional listing rules, BoardRoom delivers robust secretarial and governance support. Services include company incorporation, named secretaries, board meeting management and full regulatory reporting for SGX, BURSA and HKEX.

BoardRoom helps businesses meet evolving sustainability requirements with end-to-end sustainability reporting services. We support you from accurate data collection and climate risk assessment to drafting clear, compliant reports using recognised frameworks such as TCFD, ISSB and GRI. We also advise on available funding opportunities from local governments, enabling you to transform sustainability compliance into a strategic advantage that enhances transparency, resulting in investor confidence and long-term value creation.

The Future of BPO is Strategic

As we navigate 2025, it’s clear that BPO is evolving and is no longer about cost savings alone. It is a strategic lever to unlock growth, improve agility and enhance customer experiences.

By partnering with an experienced and integrated provider like BoardRoom, businesses can de-risk their outsourcing strategy while gaining scalable, future-ready capabilities. With technology-driven delivery, regional reach and deep functional expertise, BoardRoom is positioned to help clients thrive in an increasingly competitive global environment.

Speak with BoardRoom today about outsourcing solutions tailored to your growth strategy in 2025 and beyond. Contact us to start planning your next steps.

Related Business Insights

-

05 Feb 2026

Stress-Free Annual Tax Filing in Singapore: Practical Tips for Businesses & Individuals

Discover how BoardRoom's accounting services can help you navigate the shortage of accountants in Singapore with st …

READ MORE -

05 Feb 2026

Preparing for Financial Year End in Singapore: Complete Checklist for Compliance

Ensure a smooth and compliant financial year-end in Singapore with our expert checklist covering accounting, tax fi …

READ MORE -

01 Feb 2026

Why Digital Finance Transformation Is a Leadership Imperative

Discover how digital finance transformation empowers CFOs to drive strategy, boost agility and unlock smarter, insi …

READ MORE