Having a fuss-free, user-friendly Human Resource Management System (HRMS) is half the battle won when it comes to maximising efficiency of your HR team and even your workforce in general.

Here’s a breakdown of what you can expect when you outsource your payroll processing to an experienced regional payroll service provider like BoardRoom, supported by our HRMS platform Ignite to streamline your HR administrative process. Click the video below to view some of Ignite’s key features.

A Quick Glance on Ignite's Key Features

BoardRoom supports payroll processing in 17 countries across Asia Pacific including Singapore, Malaysia, Hong Kong, China, Australia, Japan and more. By entrusting us with your payroll, you’ll get exclusive access to our HRMS platform, Ignite.

Ignite cloud-based HRMS system is designed to meet even the most stringent payroll compliance & statutory requirements and offers up to 11 different languages (English, Traditional Chinese, Traditional Chinese Hong Kong, Simplified Chinese, Bahasa Indonesia, Japanese, Korean, Thai, Vietnamese, French and Spanish), ensuring true multi-country payroll processing. Coupled with a full suite of convenient self-service functions, Ignite enables your employees to carry out standard HR tasks without draining resources from your team.

Ignite HRMS comes with 5 core HR modules:

Payroll

Personnel

Leave

Attendance

Claims

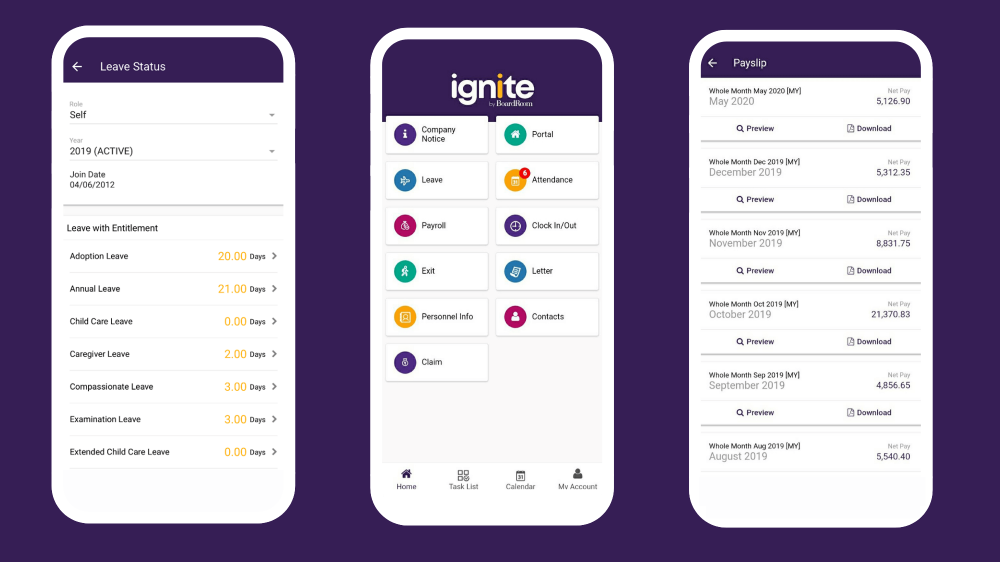

Ignite also comes with an intuitive mobile application designed for mobility to empower your workforce to stay connected 24/7, with instant access to their payslips, claims and leave application, anytime, anywhere.

Flexible user interface with Ignite, Mobile App

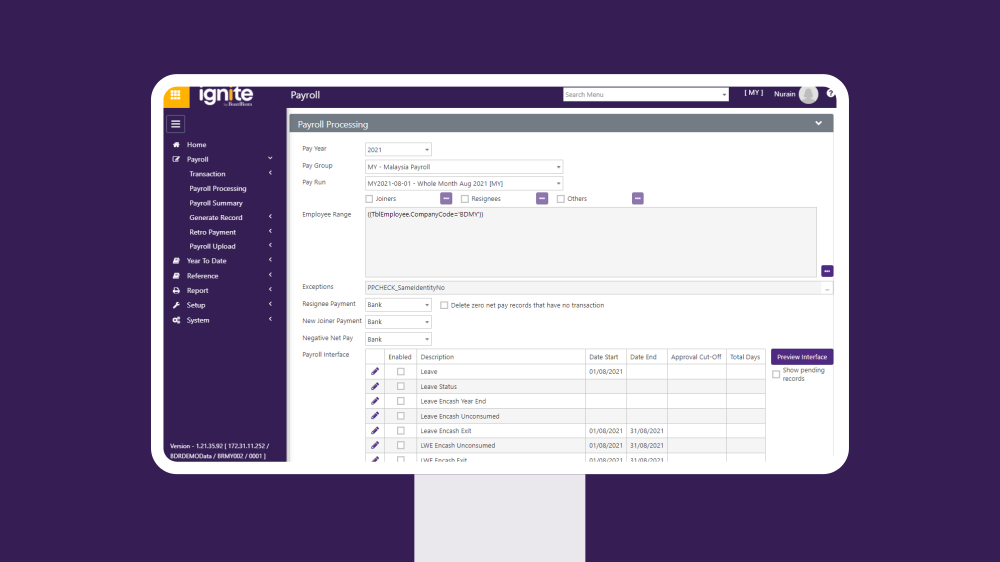

Payroll Module

Monthly payroll processing can be a tedious and stressful affair. Ignite payroll helps make these a breeze by eliminating the need for manual calculation from your payroll processing equation.

With its advanced automation function and the ability to process complex statutory compliance calculations in 10 countries across Asia, Ignite ensures utmost accuracy and efficiency for your HR team.

Payroll processing on Ignite desktop

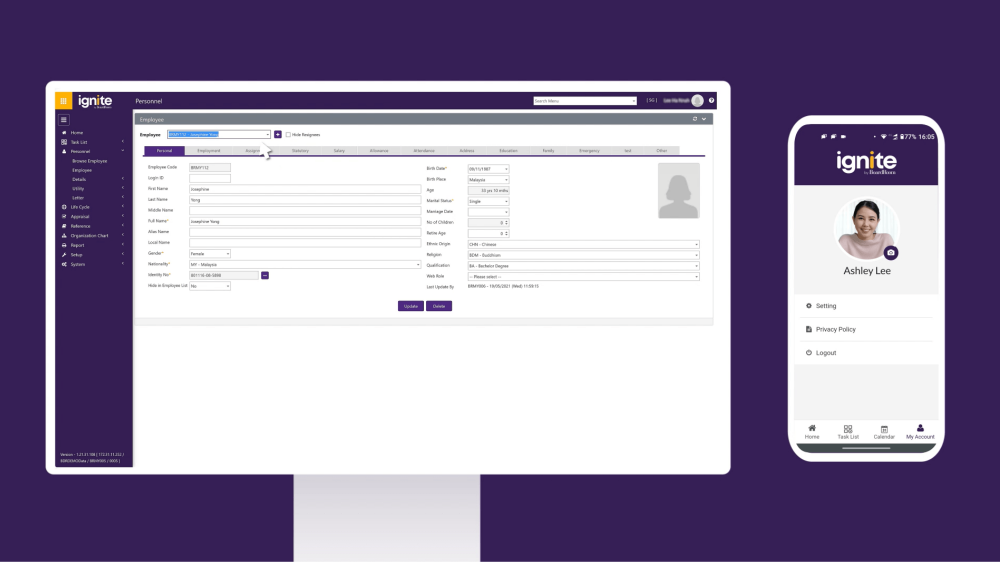

Personnel Module

Whether you’re a manager or a HR representative, Ignite can help you keep track of important employees’ details. Crisis management is a whole lot easier when you can access emergency contacts and roster information in one single platform to make the necessary calls. That’s lesser downtime for your operations and a burden off both management and employees’ shoulders.

Ignite desktop, featuring employee details management

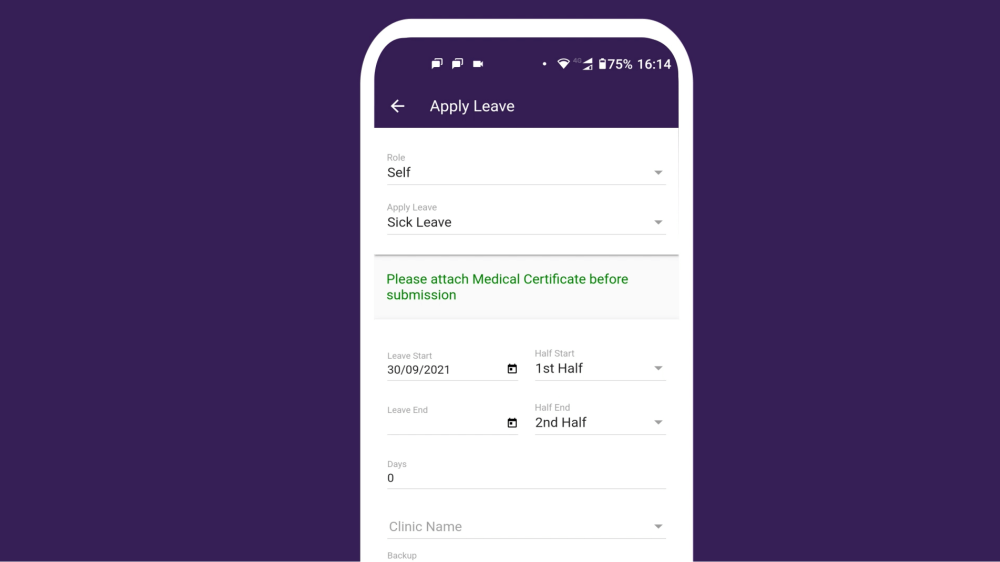

Leave Module

Managing leave is as simple as a tap of your finger. Employees can easily calculate their leave balance without consulting the HR team and effortlessly apply for annual, sick, maternity leave and more. They’ll also be able to upload supporting documents such as medical certificates the moment they apply for leave, reducing the need to remind them to send in their documents.

Ignite mobile, apply leave on the go

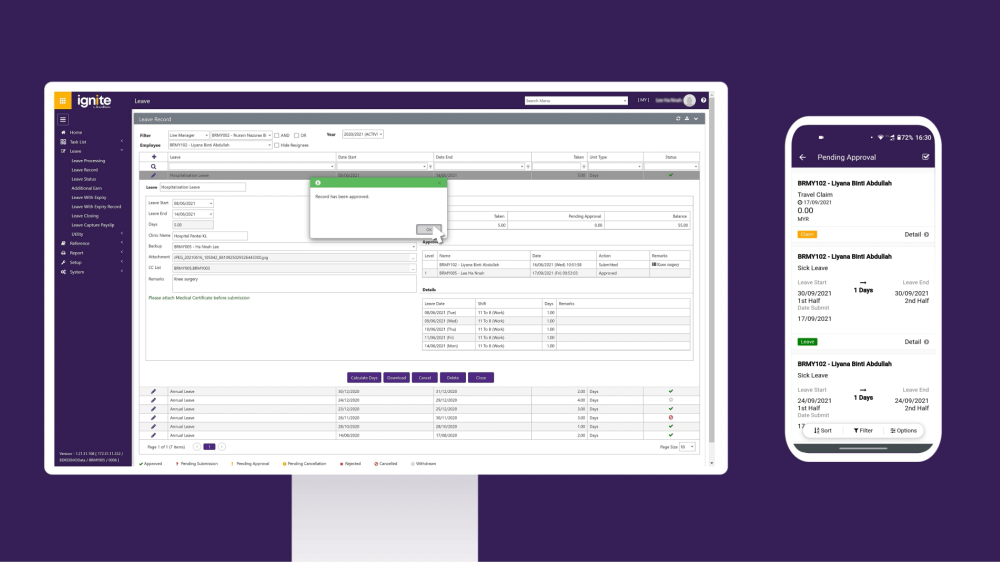

Managers can also view their employees’ leave requests – even for staff that are under a different jurisdiction’s payroll – and approve them on the go.

Approve leave on both Ignite desktop and mobile app

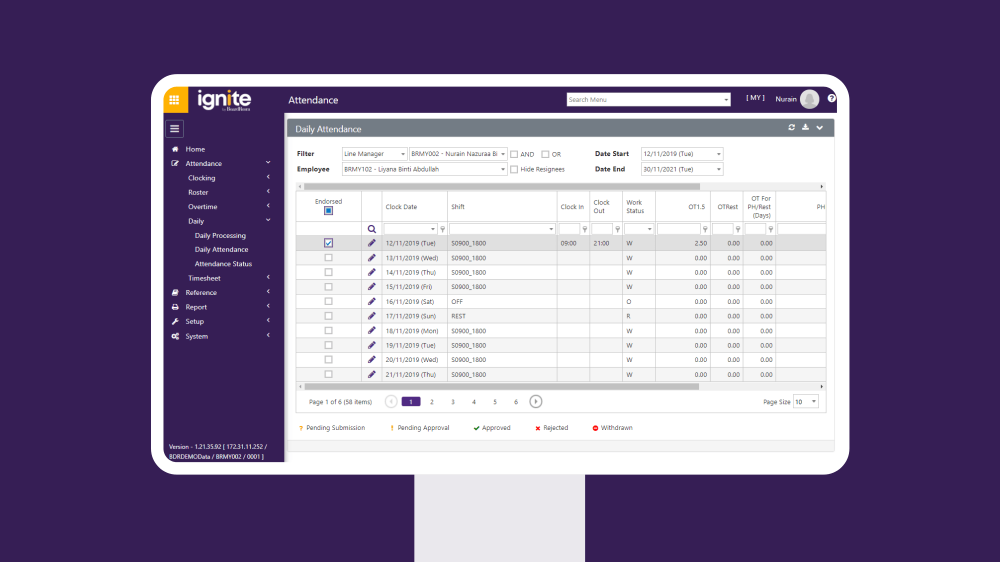

Attendance Module

Keep track of your roster changes in real-time and notify your employees of new or updated shifts instantly. Arranging shifts or calling in back-up can be as easy as consulting the calendar on your Ignite app – you’ll have a bird’s eye view of who’s available for call and how many shifts they’ve done to optimise the scheduling process. You can even set up automated notifications to back-ups and supervisors to inform everyone of who’s on urgent leave which cuts down time needed for someone to coordinate and notify those affected.

Ignite desktop showing daily attendance management

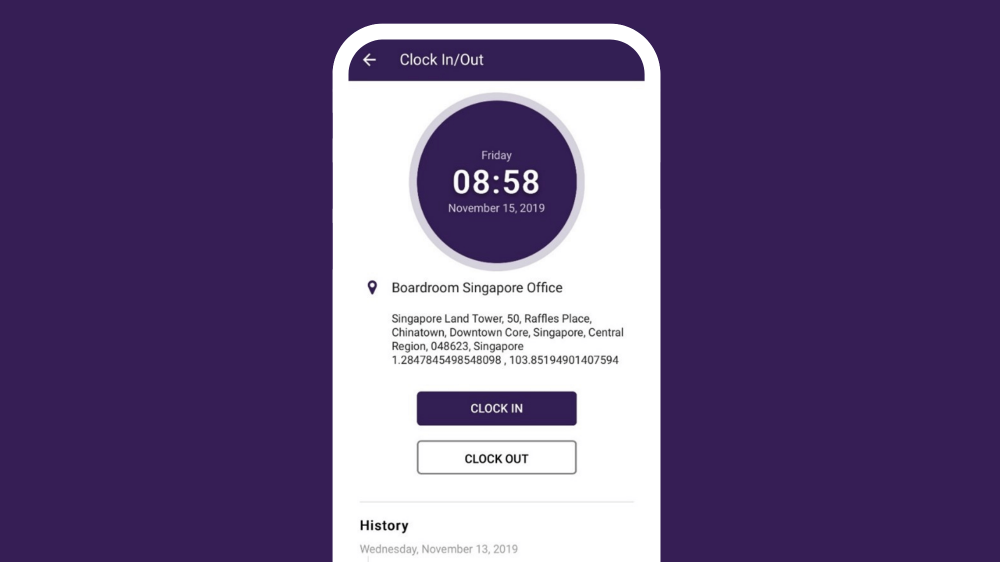

Offshore or remote working attendance clocking can be easily tracked with the use of Ignite’s GPS technology. Additionally, the integration of iBeacon Bluetooth function enables employees to clock in/out using their smartphones. All attendance data is then automatically recorded on Ignite all without the need for any manual steps.

This cuts down time needed for manual submission and verifications of timesheet for the convenience of users.

Employee attendance clocking on Ignite mobile

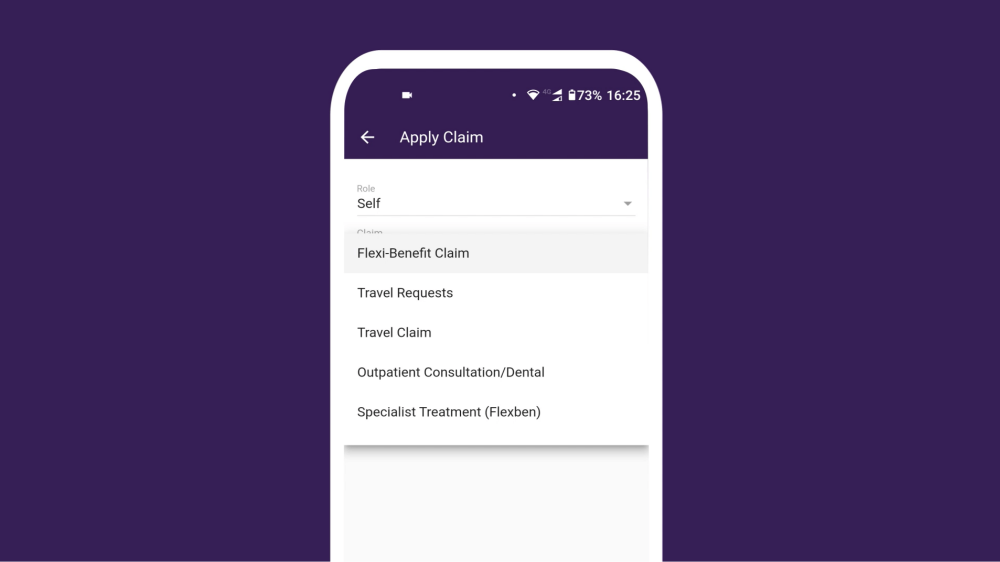

Claims Module

Claims are also a piece of cake with BoardRoom’s Ignite. Application, processing and approval all takes place on the platform. It also supports the uploading of supporting documents, even on your mobile so that you can apply for claims at your convenience.

Submit claims on the go with Ignite mobile app

Ignite is the right fit for organisations of all sizes with its all-in-one functionality including Payroll, Leave, Claims, and Time & Attendance. Your employees and HR teams will be able to benefit from the intuitive self-service features of the platform, enjoy the accessibility of a cloud based HRMS, all through the convenience of a mobile app.

Contact our payroll experts today to learn more about Ignite’s functions and how it can empower your HR team’s payroll processes.