In the wake of COVID-19, companies around the world are scrambling to adapt to rapidly changing corporate landscapes. Traditional working models are no longer effective, forcing business leaders to make quick decisions amid widespread uncertainty.

But with major disruption comes major opportunities for business transformation and expansion.

This is especially true in the Asia-Pacific (APAC) region. The perfect storm of aligned attitudes, economic promise, consumer engagement and technological advancement culminates in huge potential for businesses of all sizes to not only recover but flourish.

A bright future lies ahead

Despite the ground-shaking impact of COVID-19, APAC’s corporate sector remains dynamic. The region’s enormous internal markets, plentiful resources and wide consumer reach have provided fertile ground for a multitude of homegrown innovators and disruptors to thrive. To name just a few, think WeChat, Grab, Alibaba and Tencent.

APAC businesses have long been hungry for progress, and this collective fervour likely bolstered the region’s resilience through the pandemic. Asian GDP remained relatively stable when compared with other major economies, contracting by just 1.5%, while Europe and the United States experienced falls of 6.1% and 8.9%, respectively. Local businesses continued to scale up during this time, encouraging forward momentum that will be vital for recovery in the years to come.

Optimism across the region

The remarkable drive of APAC business owners may be due to their enduring optimism. Corporate Asia is known for its desire to work hard, achieve higher and seize opportunity.

Despite post-pandemic uncertainty, a 2021 Sun Life survey of 2,400 SME business owners found that:

- 74% expected their organisation’s financial position would improve in the next year

- 70% expected the national economic situation to improve in the next year.

This positive outlook may be why 84% of respondents planned to expand their business in 2022.

Opportunities abound

Local governments in APAC tend to share the progressive attitudes of their commercial counterparts, especially when it comes to digital innovation and economic recovery.

Supportive initiatives like Singapore’s Smart Nation continue to be introduced across the region, creating valuable opportunities to collaborate with local partners.

The positive outlook for Asia’s economic growth is further buoyed by a growing consumer class: MGI research indicates that 70% of Asia’s total population is expected to be part of the consuming class by 2030 — up 15% since 2000.

APAC is also uniquely positioned to leverage the digital boom that is revolutionising the business-to-consumer landscape. During the pandemic, 60 million people became online consumers in South-East Asia alone.

How businesses can realise their full potential

Companies doing business in Asia have a rare opportunity to use the region’s post-pandemic optimism as a catalyst for expansion. According to McKinsey and Company, a prosperous new era for Asia is within reach if companies engage in a collective effort to grow and break new ground.

The recent Regional Comprehensive Economic Partnership between ASEAN, China, India, Australia, South Korea, Japan and New Zealand will support widespread business development in a number of ways. Importantly, it will strengthen regional economic collaboration by making regional trade and investment safer, easier and more efficient.

To take advantage of new opportunities for intraregional expansion and connectivity, Asia-Pacific enterprises need to be proactive about adapting their operational and commercial strategies accordingly.

The power of digitisation

Asia has the most significant number of mobile phone users globally — a fact not gone unnoticed by the region’s corporate sector. Local companies are embracing tech faster than anywhere else globally, with the pandemic serving to accelerate this process.

For example, sales of industrial robots in China rose by almost 20% in 2020.

Perhaps unsurprisingly, Asia is the fastest-growing region in international e-commerce, meaning digitisation is a must for most businesses wanting to get ahead.

Strength in partnership

Tech adoption not only opens up business-to-consumer opportunities but also supports business-to-business relationships, which will be vital for APAC’s economic recovery. Initiatives like Go Digital ASEAN are already supporting more cross-country collaboration and market access throughout the region.

A digitised landscape promotes fluid borders, making it easier for businesses to join intraregional trade networks and thereby increasing Asia’s share of global trade. And as more businesses expand, Asian economies will benefit from each other’s strengths.

With Asian companies historically favouring alliances, businesses that successfully branch into neighbouring countries now can expect a significant return on investment.

Climate adaptation and sustainability

The climate emergency brings many risks for businesses, while climate adaptation provides opportunities. Business leaders will need to account for both if they are to secure growth and resilience for their organisation in the long term.

Five countries in Asia have proposed or passed legislation mandating net-zero emissions, which businesses will need to cater to in their operations and strategies.

Opportunities for climate innovation are more abundant than ever. With the costs of solar and land-based wind energy in China and India among the lowest in the world, both regions are positioned to dominate global growth in solar and wind.

Focus areas for leaders looking to expand

In many ways, the proliferation of APAC’s economy now rests on the shoulders of its business leaders. To keep up with the region’s comparatively rapid pace of change, leaders must be bold and agile in their approach to business performance improvement.

Leaders’ focus areas need to shift. There needs to be greater attention given to corporate governance — which lags behind Western standards — working models and resource allocation, as well as digital innovation and consumer trends.

1. Business operation enhancement

Throughout APAC, working environments are changing. Many businesses are implementing hybrid models, with the upshot being greater employee satisfaction and access to broader talent pools. Leaders are also taking action to speed up decision-making and productivity by removing silos and increasing employee autonomy.

If your work environment reflects a traditional model, you may need to identify modernisation opportunities as part of your expansion plans.

With the continued localisation of supply chains and increase in domestic trade, businesses will also likely benefit from following APAC’s regionalisation trend. Intraregional partnerships often impart valuable consumer insights, especially if the companies in question collect vast pools of data via their service provision. For example, grocery chain Freshippo allows Chinese enterprises, new and established, to share data in omni-channel supermarkets.

Strengthening your operations with corporate partnerships will give your growing organisation extra support and resources to thrive.

2. Product and process innovation

Asia is home to more than half of the global population, with billions of people engaging with brands online. This means innovative, well-executed digital marketing strategies are likely to exceed expectations.

According to Sun Life, over 90% of business owners changed their business strategy in response to the pandemic, with new methods of distribution and virtualisation introduced. Research also found businesses that invested in innovative strategies experienced positive changes in performance.

So, where should businesses put their best creative thinkers to work? With the digital generation expected to make up half of Asia’s consumption by 2030, technological innovation in products and processes should help fast-track businesses’ marketing success.

Increased spending is expected for:

The opportunities for digital product and service innovation are virtually limitless. For example, DBS Bank experienced an incredible 400% increase in their customers’ use of digital tools.

Whether your business sells products or services, investment in digitisation improvements and opportunities may boost your revenue to a significant degree.

3. Go-to-market excellence

To achieve go-to-market success in APAC today, businesses need to intimately know their consumers — and themselves.

Asia’s new consumers are early adopters of new technology, so it is a good time to take risks with technological innovation. Consider how Grab and Didi quickly acquired ride-hailing giant Uber in South-East Asia and China respectively: despite direct competition from Uber from the outset, both of these start-ups found better ways to meet the needs of local rideshare users through tech.

Businesses will be wise to use the data they generate from sales to better service their target audiences. In contrast to Western attitudes, Asian customers are generally content to share their data with companies.

When it comes time to expand, maintaining consistency of brand identity and reputation becomes harder but also more vital. A 2017 Stewardship Asia Centre study showed that 80% of successful and long-standing family businesses had a clearly defined purpose.

Essentially, businesses need to reaffirm their core purpose and make sure it is communicated effectively to their internal teams and their audiences.

Grow successfully with a corporate services provider

There is no doubt that expansion will provide many rewards for businesses that act now, but it is important to do it right. Each APAC country comes with its own cultural nuances and regulatory system, so business functions, strategies and go-to-market plans need to be customised to suit.

For example, payments platform Stripe has developed tailored products for each region in which it operates, with e-wallets and bank-based systems rolled out in Singapore and Malaysia respectively.

But regional differences should not cause businesses to hesitate, for the perfect solution may lie in engaging the services of a corporate services provider.

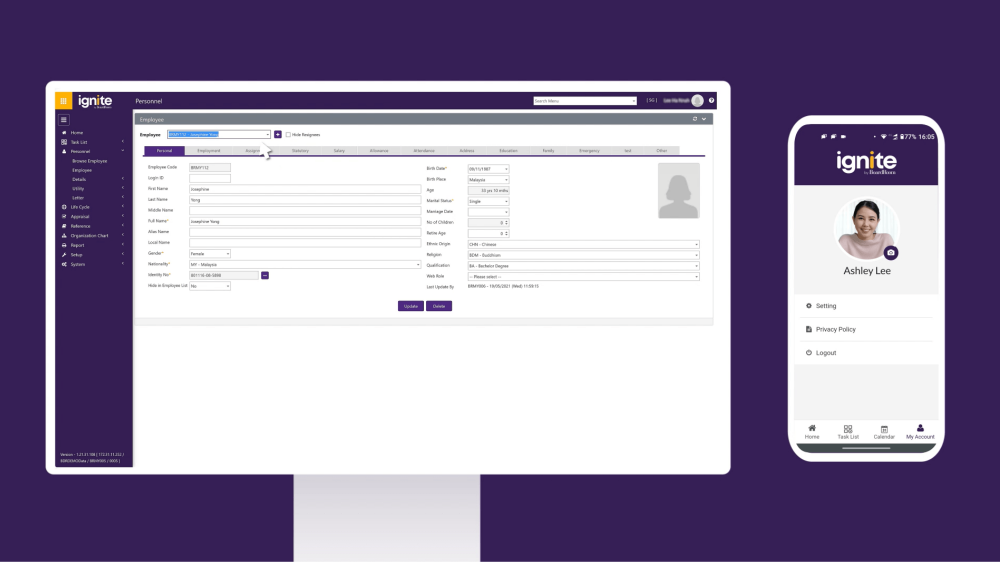

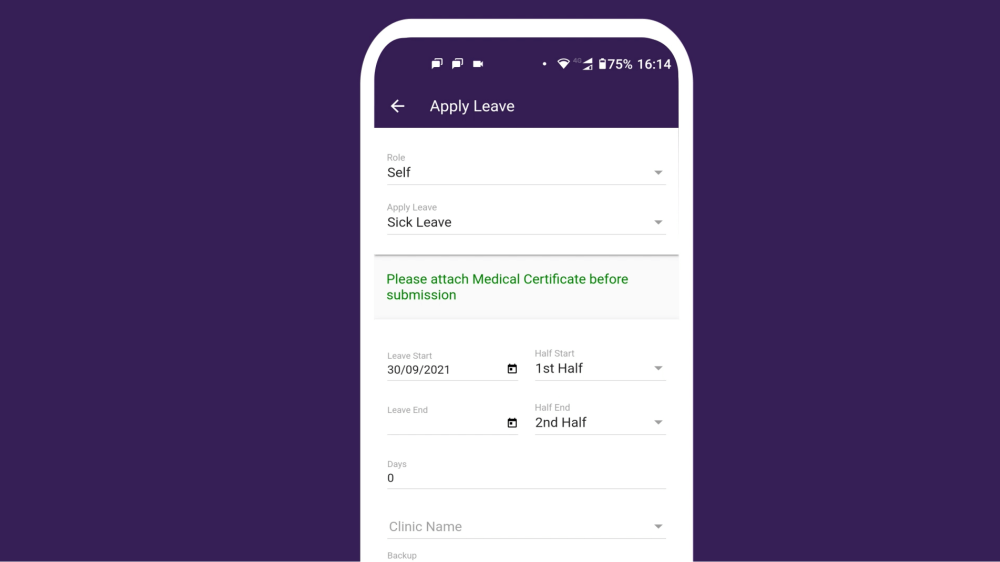

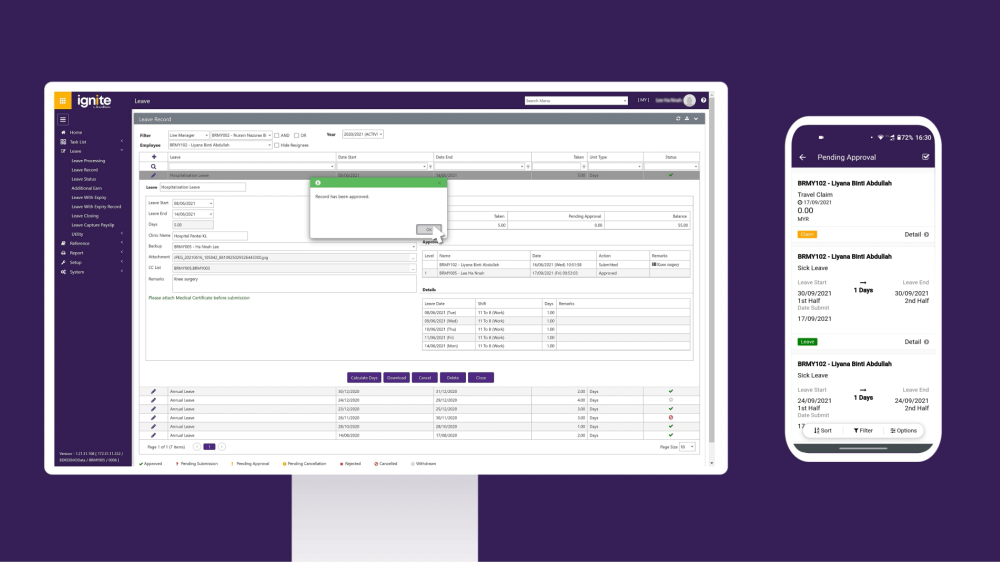

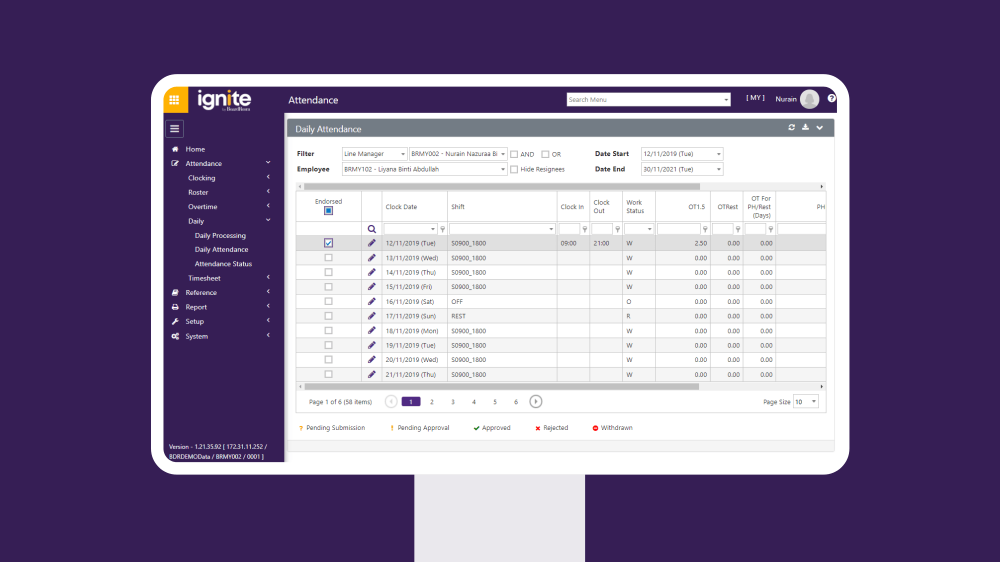

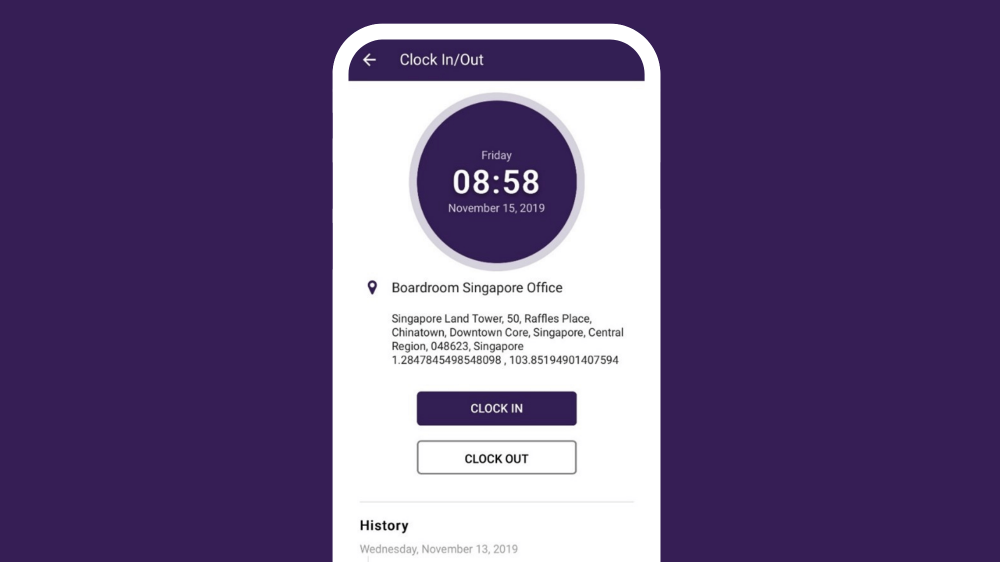

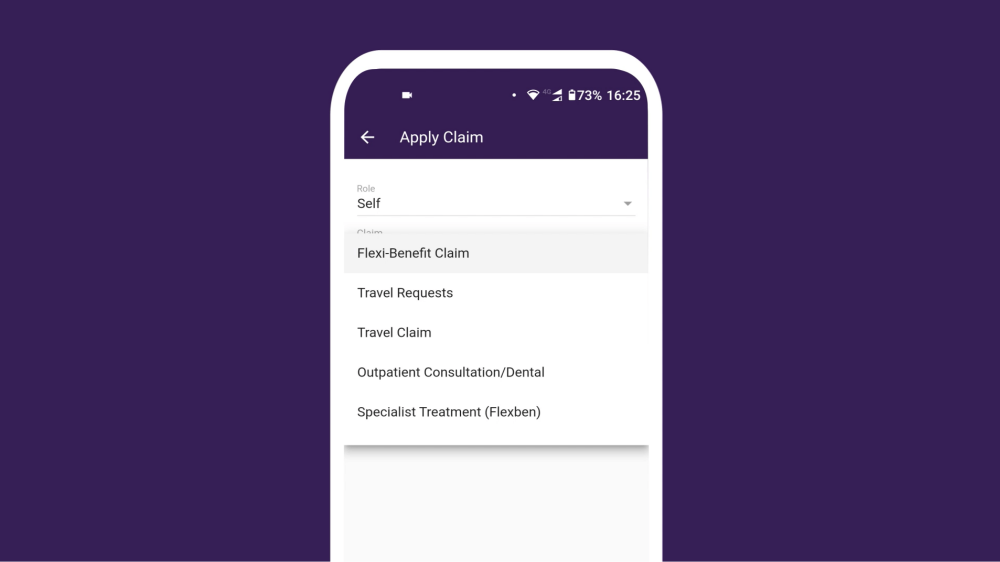

Innovative full-service providers like BoardRoom are able to handle a wide range of essential corporate functions. They manage everything from payroll to company secretarial while providing clients with one point of contact for fast and easy communication. With comprehensive local knowledge and commercial experience, they can advise companies on the best way to cater to customer preferences in each region.

It is important to choose a global firm that can grow with you, empower your team to make smart decisions and help you form critical partnerships locally.

Now is the time to act

To achieve success in post-pandemic APAC, businesses must traverse untrodden ground. Traditional strategies need to be rethought, and creativity must be employed to leverage fresh opportunities.

But as businesses collectively expand beyond borders and company incorporation rates rise, contributions to workforces, suppliers and households will increase, supporting a healthy economy as a result.

BoardRoom provides world-class service at a local level to help your business grow and prosper throughout APAC.

Contact us for a one-on-one discussion about your individual expansion plans and business goals.

Related Business Insights

-

05 Apr 2024

What Are the Key Benefits of Outsourcing Accounting Services?

Explore the advantages of engaging BoardRoom’s accountancy services, a leading accounting firm offering tailored …

READ MORE -

05 Apr 2024

What Factors Should Businesses Consider When Choosing the Right Accounting Firm?

Explore key factors for choosing the right accounting firm. Partner with BoardRoom for the best financial managemen …

READ MORE -

22 Mar 2024

ESG Reporting Essentials – Your Guide to ESG Reporting in Singapore

Boost transparency and build trust with comprehensive sustainability tracking and ESG reporting solutions. …

READ MORE